As election day approaches, voters are paying more attention to each candidate’s positions on a host of issues. In the area of tax policy, both major-party presidential candidates have offered sharply different views on how the tax laws should be changed, preserved or expanded in order to help alleviate the economic consequences resulting from COVID-19, promote policy objectives and turn around a struggling US economy. It is important to note that while the candidates’ current proposals contain very little detail and may change over time, the available information on the respective tax plans highlight significant fiscal and tax policy differences.

Biden Tax Plan

Former Vice President Biden’s tax plan addresses a variety of areas impacting businesses, individuals and estates including targeted rate increases, expanded middle-class incentives and measures to promote certain policy objectives or industries.

Corporations and high-net-worth individuals are specifically targeted through income rate increases and reduced incentives. The Biden plan increases the corporate income tax rate from 21% to 28%, increases the effective rate on Global Intangible Low Tax Income (GILTI) earned by US-based multinationals from 10.5% to 21%, and creates a 15% minimum tax income for companies reporting book income in excess of $100 million that owe no US income taxes. For individuals, the plan restores the top income tax rate of 39.6%, imposes a cap of 28% on the value of itemized deductions, applies ordinary rates to long-term capital gains and qualified dividends for those with a taxable income over $1,000,000, phases out the deduction under Section 199A for passthrough entity owners with income over $400,000, and applies the Social Security payroll tax to wages of more than $400,000. With respect to transfer taxes, the Biden plan increases the estate tax from 40% to 45% and repeals the basis step-up for inherited assets.

The Biden plan also expands tax incentives, particularly those benefiting middle- and lower-income taxpayers and addresses certain industry sectors. The plan increases the child and dependent care tax credits, establishes a new $5,000 informal caregiver tax credit, a refundable “First Down Payment” tax credit up to $15,000 for first-time homebuyers, and various alternative energy and retirement savings incentives targeting middle-class consumers. The Biden plan also targets certain industry sectors including tax breaks for real estate investors (like-kind exchanges), the imposition of a “risk fee” on large financial institutions and the elimination of fossil fuel industry incentives. However, the plan does expand the investment credit for the alternative energy sector, makes reforms to the Opportunity Zone program, expands several other tax credits including the new markets tax credit, the work opportunity tax credit and low-income tax credit, and establishes a new “manufacturing communities credit” to encourage investment in communities that have experienced significant job losses.

Trump Tax Plan

In contrast to the Biden tax plan, the Trump Administration’s announcements, agendas and previous budget blueprints reflect a tax plan geared toward economic growth, and generally outline a policy that the temporary relief measures enacted in the Tax Cuts and Jobs Act (TCJA) should be extended or made permanent. Thus, under the Trump tax plan, the top rate for corporations will remain at 21% though the President has discussed lowering the rate to 20%. The top rate for individuals–currently 37% including a 20% deduction for passthrough entity owners–will also remain unchanged. President Trump has indicated plans to lower the long-term capital gains rate to 15% or indexing for inflation, make permanent cuts to the payroll tax and make further tax cuts benefiting the middle class including lowering the current 22% tax rate for individuals to 15%. For businesses, the Administration listed the following tax themes: “Made in America” tax credits, tax cuts to keep jobs in America, tax credits for companies that bring back jobs from China, 100% expensing deductions for essential industries like pharmaceuticals and robotics that bring manufacturing back to the US, restoring the deductibility of meals and entertainment costs, and extending business tax breaks in the TCJA. The Trump plan embraces TCJA and seeks to extend its tax provisions while at the same time provide taxpayer incentives to restore economic growth.

To be sure, individuals, businesses and estates would all likely be impacted under each candidate’s tax policy proposals should they become law or if certain provisions in TCJA are extended. In addition to possible tax rate changes, taxpayers should assess how these tax proposals might impact their decisions as it relates to business operations, investments, employment and estate planning. These evolving tax policy proposals offer important insights on what voters will likely experience and debate during the next Administration.

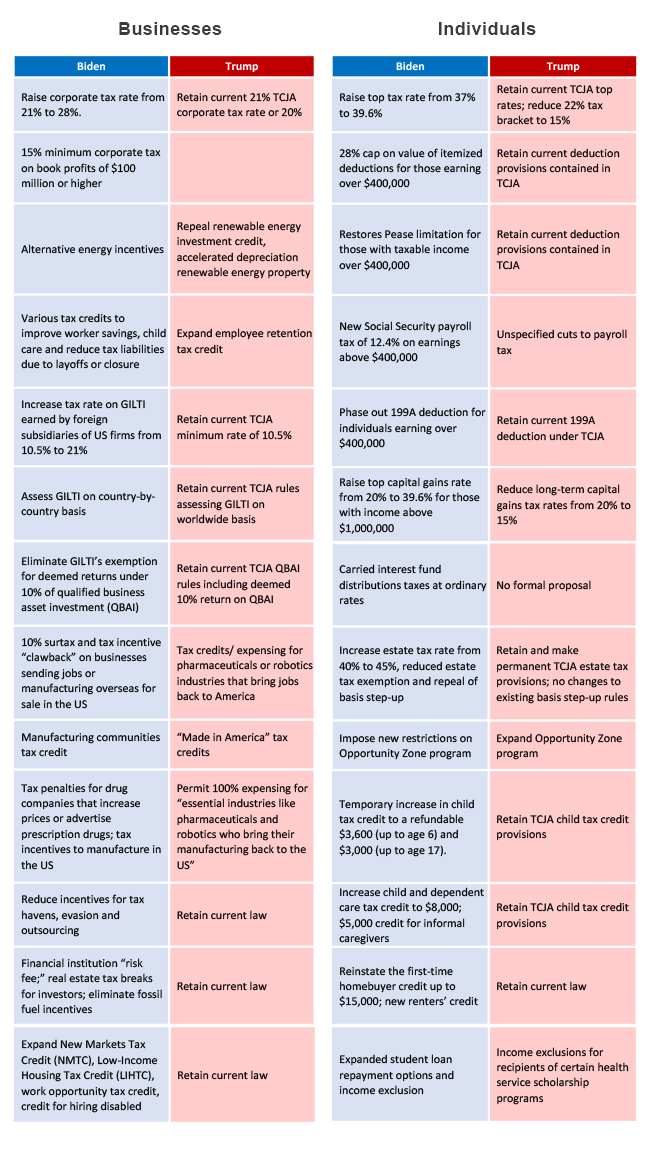

Below is a summary chart based on available information that identifies relevant items contained in President Trump’s and former Vice President Joe Biden’s respective tax plans.

Compliments of Marks Paneth LLP – a member of the EACCNY.

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](http://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)