BDO USA –

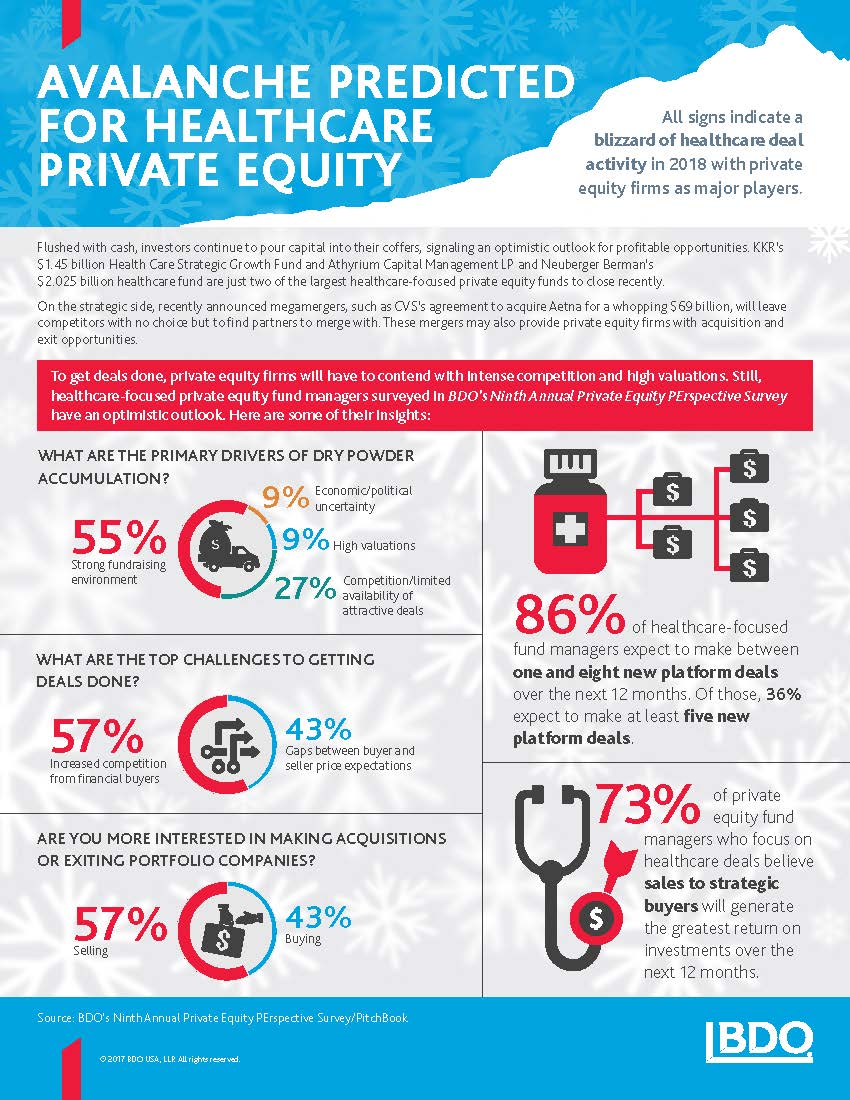

Flushed with cash, investors continue to pour capital into their coffers, signaling an optimistic outlook for profitable opportunities. KKR’s $1.45 billion Health Care Strategic Growth Fund and Athyrium Capital Management LP and Neuberger Berman’s $2.025 billion healthcare fund are just two of the largest healthcare focused private equity funds to close recently.

On the strategic side, recently announced megamergers, such as CVS’s agreement to acquire Aetna for a whopping $69 billion, will leave competitors with no choice but to find partners to merge with. These mergers may also provide private equity firms with acquisition and exit opportunities.

Compliments of BDO USA – a member of the EACC in New York

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)