2nd Quarter 2020

[Data for Q4 2019 & Year 2019]

The Transatlantic Business & Investment Council (TBIC) is the official European representative of selected counties, cities and corporations from over 30 U.S. States. It is our mission to promote transatlantic trade and investment. To that end, the TBIC bridges the gap between Economic Development Organizations (EDOs) and European investors looking to enter or expand in the U.S. market.

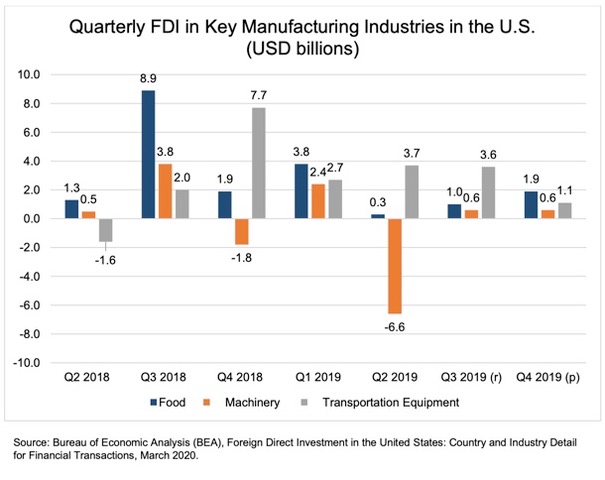

In this edition of our Quarterly, we present data for the entire year of 2019, including the preliminary (p) numbers for the fourth quarter (Q4), as well as revised (r) numbers for the third quarter of 2019 (Q3) as recently published by the U.S. Bureau of Economic Analysis (BEA). Direct investment into the United States (including equity & debt instruments) rose from USD 32 billion in Q3 to USD 68.7 billion in Q4 2019. Together with a revised number for the third quarter – down from USD 33.9 to 32 billion – total FDI in 2019 in the U.S. amounted to roughly USD 261.5 billion, showing a decrease of 2.6% compared to total FDI in 2018. Direct investment in the food sector rose in the fourth quarter of 2019 compared to Q3 2019, while FDI in the machinery sector remained at USD 600 million and FDI in the transportation sector decreased from USD 3.6 to 1.1 billion. With regards to European source countries, it is noteworthy that Germany remained a top source for European FDI in the United States throughout 2019 despite slowing growth of its domestic economy. With 2019 wrapped up, this edition’s spotlight article already aims to provide you with an update on the ongoing COVID- 19 crisis and how it affects FDI in the United States in the first half of 2020.

In this analysis, the TBIC corroborates relevant country data with its own experience of working at the frontier of transatlantic investments: the TBIC regularly visits key markets in Europe that have become drivers of FDI in the United States as part of Delegation Trips offered exclusively to our members. These trips feature meetings with decision-makers from companies looking to invest in the United States as well as key multipliers from diplomatic missions and industry associations. To find out more, please click here!

Foreign Direct Investment in the United States: Key Figures

• In the newly published data for the fourth quarter of 2019, FDI inflows in the third quarter of 2019 were marginally revised downwards from USD 9 to 32 billion. Meanwhile, the data for Q4 2019 showed an inflow of USD 68.7 billion. This is more than double the FDI flows in the previous quarter, and well within the quarterly average of USD 76.8 billion over the last 3 years.

• Total investment in the S. in 2019 stands at USD 261.5 billion – a decrease of 2.6% compared to 2018, but nevertheless the fifth strongest year over the past decade in terms of FDI. With regards to 2020, the United Nations Conference on Trade and Development (UNCTAD) currently forecasts a 30% to 40% drop in global FDI during 2020-2021, depending on the severity and duration of the COVID-19 pandemic. For comparison, after the global financial crisis of the late 2000s global FDI flows dropped 35% – with a strong rebound the following year, especially with regard to FDI in the United States.1Moreover, eventual efforts at near-shoring production to enhance operational resilience might also factor into a resurgence of FDI in the second half of 2020 and the year 2021.

• In the newly published data for Q4 2019, the numbers for the third quarter of 2019 have been revised – with the food sector being revised down slightly by USD 100 million to USD 1 billion and the machinery sector facing a slight downgrade from USD 800 to 600 The revised data on the transportation sector show for an increase of USD 1.3 billion the third quarter of 2019, from a previously predicted USD 2.3 to now 3.6 billion.

• The fourth quarter of 2019 showed an increase in FDI in the food sector by USD 900 million to a total of USD 9 billion compared to the previous quarter, while the machinery sector remained at USD 600 million. Furthermore, numbers for the transportation sector went down by USD 2.5 billion quarter-to-quarter.

• Even though we see a prognosed drop in FDI in the transportation sector from USD 3.6 billion in Q3 2019 to USD 1.1 billion in Q4 2019, for the year of 2019 the figures show an increase of FDI in this important sector from a total of USD 9.4 billion in 2018 to USD 11.1 billion in 2019.

Below, we have updated the U.S. FDI flow data for Germany, the United Kingdom and Switzerland from our last Quarterly with the most recent data on the fourth quarter 2019:

• The numbers for Q3 2019 have been revised for these three source countries: German FDI was revised downwards from USD 4 to 2.0 billion; FDI from the United Kingdom was revised from USD -1.4 billion to – 200 million; and direct investments from Switzerland were revised from USD 1.1 billion to 800 million.

• While the fourth quarter of 2019 shows an increase of German and Swiss FDI from USD 0 to 10.9 billion and USD 0.8 to 6.3 billion, respectively, compared to the third quarter of 2019, UK FDI shows a further decline from USD -0.2 to -3.8 billion. Throughout the year 2019, Germany has remained one of the strongest sources of European FDI to the United States.

TBIC Spotlight Article: Updates on the COVID-19 Crisis

(This article summarizes parts of a TBIC webinar in March 2020. The data has been updated on May 28, 2020)

Since the beginning of the year, COVID-19 has had the world in its grip. As of today, over 5.6 million people in 188 countries have been tested positive for SARS-CoV-2 and around 355,700 people have succumbed to COVID-19. The ongoing COVID-19 crisis forced shutdowns of public and work life worldwide. Below we provide you with a follow-up to our TBIC webinar on the impacts of the COVID-19 crisis, including updated political and economic data for the situation in selected European FDI-source-countries, as well as a tentative outlook for the months ahead, based on observations in China.

A bird’s eye view of the global economy provides a gloomy picture: according to the International Monetary Fund (IMF) and OECD, global economic output will drop by up to three percent in 2020. Global trade is expected to decrease by three to five percent compared to the previous year. A severe recession seems no longer avoidable in the United States, Europe and Japan. Production stoppages, transport obstacles, slumps in demand and disruption of supply chains affect most industries worldwide.

During March and April, Europe had been the epicenter of the COVID-19 crisis. In addition to national governments, the European Commission also adopted a comprehensive economic response to the economic crisis following the outbreak which includes the setup of a EUR 37 billion (approx. USD 40 billion) Coronavirus Response Investment Initiative to provide liquidity to small businesses and the health care sector. Since March, all external EU borders are closed for non-essential travel and inner EU borders are partly closed, depending on national regulations. Each European country has responded differently to the outbreak which results in varying degrees of regulations and restrictions across the continent. Now, at the end of May, many European countries are already executing their exit strategies in order to bring their countries out of the shutdowns.

More than 181,000 SARS-CoV-2 infections have been registered in Germany, with over 8,400 fatalities due to the virus. Even though Germany implemented no strict national shelter-in-place order, all public life has been substantially restricted since the middle of March. As of late April, stores are slowly reopening, health protective measures for public places are tightened and schools started to reopen. The relief package of the German government includes cash grants for small and medium companies, as well as a EUR 600 billion (approx. USD 670 billion) security bond for industry and short labor compensation.

In the UK, the number of confirmed SARS-CoV-2 cases now exceeds 268,600; total deaths are 37,500, making it the European country with the highest number of deaths. However, British statistics are considered only of limited validity given the lack of sufficient testing and registration of deaths outside of hospitals. Notably, UK Prime Minister Johnson had to be hospitalized for treatment against COVID-19 including a stay in ICU. The fairly strict lockdown established on March 23rd for an initial three weeks had been extended well into May. Now, in late May, the lockdown regulations are beginning to loosen, the “open-air recreation” limits have been lifted and primary schools are planned to reopen before the end of the term. Between March 23rd and April 5th, one in four businesses (25 percent) reported they had temporarily closed or paused trading; of those still operating, 54 percent reported a lower turnover than usual and 21 percent reported furloughing staff. In response, the government has so far committed roughly GBP 65 billion (approx. EUR 74 billion; USD 81 billion) to support the economy – already eclipsing the amount spent during the 2008 financial crisis.

France has the third highest case count in Europe after the UK and Italy. More than 28,500 people have died from COVID-19. However, both the number of new deaths and the number of patients requiring intensive care are falling. More than 183,000 SARS-CoV-2 cases have been confirmed nationwide. On March 17th, the country-imposed a near-total lockdown with strict curfews for its citizens, in place until May 11th, after which limitations are now being loosened. The French government implemented a row of measures with immediate effect to support companies affected by the COVID-19 crisis. These measures and higher healthcare expenditure will be financed by a supplementary budget of EUR 45 billion (approx. USD 49 billion). The package of measures covers approximately 13 percent of France’s economic output.

In Italy, more than 33,000 people have so far succumbed to the illness, but the numbers of deaths per day and of people in intensive care units are declining. Over 231,100 people have tested positive for SARS-CoV-2. At the end of March, the government had ordered a complete production halt in all non-necessary industries – unique in Europe. These regulations are since being loosened. Starting at the beginning of May, citizens were allowed to leave their houses, while schools will remain closed until September. The Italian business association Confindustria has calculated that the production shutdown is costing the Italian economy around EUR 100 billion (approx. USD 108 billion) a month and is expecting economic output to drop by six percent this year. The Italian government decided on a first EUR 25 billion (approx. USD 27 billion) relief package and will reportedly decide on another package soon. A large proportion of the aid package is directed at supporting labor and employment while also including tax breaks to support the liquidity of companies.

By late March, Switzerland had one of highest per capita rates of confirmed SARS-CoV-2 infections. As of today, the number of people with confirmed SARS-CoV-2 infections is just shy of 31,000, with 1,900 fatalities. As elsewhere in Europe, the curve has been flattening: daily numbers of confirmed new infections as well as the number of persons hospitalized for COVID- 19 have been decreasing for the past month in Switzerland. The Swiss federal government had established emergency lockdown measures on March 16th. 180,000 businesses have since applied for government aid in the form of partial unemployment benefit, allowing them to retain but reduce their staff’s working hours. This affects 1.85 million of Swiss workers, or 36 percent of all employees in Switzerland. By mid-April, the Swiss government presented a three- step exit plan from the emergency lockdown measures, the first stage of which have since been enacted.

Lastly, we want to provide a brief overview of recent developments regarding the slowing of the COVID-19 pandemic in China as a baseline for potential developments in the rest of the world. The first lockdowns in China were instituted on January 23rd, 2020 and from the beginning of April have started to slowly be lifted, after no domestic transmissions had officially been reported on March 18th, 2020. Even though China is again battling local transmissions and has practically barred all international travel to restrict the importation of cases, the country continues to be closely monitored for evidence of a possible quick rebound from the crisis. The economic consequences of the lockdown were severe: capital investments fell by 24.5 percent, retail sales by 20 percent, industrial production overall by 13.5 percent, and the value of exports by 15 percent. However, already in March some economic indicators coming from China showed signs of recovery, as the Caixin China General Composite Purchasing Managers Index (CGPMI) – a key indicator of producer’s expectations – recovered from a low of 29 percent in February to 52 percent in March. Moreover, after car sales had plummeted by 80 percent in February, German car maker Daimler reported a pickup in activity on the Chinese market in March with 50,000 vehicles sold. While these are hopeful signs, at what pace European economies can be expected to rebound largely rests on how quickly they manage to contain the virus, lift restrictions and thus may return to a “new normal”.

The TBIC will continue to monitor the development of the COVID-19 crisis in Europe and update its members accordingly.

*The SARS-CoV-2/COVID-19 numbers in this article are from John Hopkins CCS and European Centre for Disease Prevention and Control, last accessed 05/28/2020

Compliments of the Transatlantic Business & Investment Council (TBIC), LP.

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)