Overview

2018 is shaping up to be a year defined by significant volatility and continued uncertainty. While consensus has developed around near term US monetary policy, timing and direction of US fiscal policy are anything but certain, and the combined effect of both is unpredictable. Developments beyond our borders, among them Brexit, central bank actions, and geopolitics will also play a pivotal role in currency movements in the coming year, and are all subject to a range of outcomes.

Below are a number of key themes for the year ahead, as well as a deeper dive into the outlook for a number of the majors.

Themes

Rising yields and the challenge to asset markets

With the Fed now both in a rate hiking cycle and selling their bond portfolio back to the market, the risks of a sharper rise in yields have increased. This is all the more true with others also getting in on the monetary tightening act. The Bank of England is threatening to raise rates, possibly as early as November, and at their October meeting the European Central Bank provided guidance on their plan for tapering and ending their asset purchases. Admittedly, this represents a reduction in the pace of and a halt to easing rather than a tightening, but the theme is clear. The extreme monetary accommodation provided by central banks in the wake of the 2008 financial crisis and the subsequent aftershocks is starting to be removed.

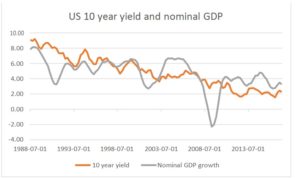

Such a significant change in the policy landscape inevitably carries substantial risks for financial markets. The primary question is whether we will see a sharp rise in bond yields and with it a halt or reversal to the rise in equity markets that we have seen in recent years. Certainly, bond yields still look low by historic standards, as the chart below plotting US 10 year bond yields against nominal US GDP shows. US inflation and growth around 2% at close to full employment would historically normally mean 10 year yields of 4% or more. At the same time, equity markets are trading at historically high p/e ratios, reflecting the low level of yields. As it stands, equities still look to be at reasonable value given the low level of yields, but a rise in bond yields would make equity valuations look stretched unless it was accompanied by a big rise in corporate earnings or a significant improvement in the market’s assessment of growth prospects.

Elsewhere the case for higher yields is less clear-cut, with the ECB for instance still conducting quantitative easing, but inflation is widely seen to have bottomed, growth is generally seen to be at or above trend and unemployment is falling around the developed world. The lack of a significant rise in yields so far likely reflects the fact that yields would have gone lower in previous years had it not been for the zero lower bound, but the risk of a sharp rise has certainly increased.

For FX markets, the impact of a sharp rise in bond yields is somewhat unpredictable as it will in part depend on movements in yield spreads, but if, as seems likely, it is accompanied by a general sell off in risky assets, it is likely to benefit the “safe haven” currencies, or those that speculators are using as funding currencies for positive risk positions.

Source: FRED (Federal Reserve Bank of St Louis economic data)

US fiscal policy – a damp squib?

Much of 2017 has been spent waiting for the Trump administration to deliver either a tax cut or infrastructure spending, or both. The strength of the USD at the end of 2016 was predicated on this outcome, and consequently the USD has struggled for most of 2017 as the hoped for fiscal boost hasn’t arrived. Now, there is no longer much expectation of any impact from a fiscal boost. The tax plan as laid out at the end of September may yet be watered down by Congress, and in any case most forecasters don’t see it having a major impact on US spending, boosting growth by a modest

0.1-0.2%. Trump has yet to detail the proposed $1trn infrastructure plan, even though this seems to have bipartisan backing, mainly because no suitable funding option has been found. Nevertheless, it can’t be ruled out that it will come to fruition in 2018, and given the lack of market expectation, the risk is mostly on the upside. So the risks from this now look to be USD positive, although the danger is that if it does get delivered, the positive economic and market impact will be offset by a resultant rise in bond yields.

Brexit – now it gets serious

There is very little optimism about Brexit negotiations, with minimal progress having been made in the current talks. So much so that there is increasing talk in the UK press that the government needs to make plans for a “hard” Brexit, in which the UK leaves the EU with no trade deals agreed. Not only does Theresa May’s government face problems in reaching agreement with the EU, there continues to be little agreement within the Conservative party on the best options to pursue. May herself is deemed by most to be very insecure in her position as leader, and is only expected to hang on because the party is too disunited to support another candidate. Nor does the opposition Labour Party have a coherent united approach to Brexit, with the current leadership historically opposed to the EU but attempting to garner support from the youth vote by presenting themselves as the more pro-European party.

Nevertheless, markets have been fairly kind to GBP in 2017 despite this lack of progress. GBP hit its lows against the USD and the EUR in October 2016 following the June referendum and has recovered steadily against a weak USD since, though its recovery against the EUR has been less consistent. This performance has partly reflected some negative market expectations of the UK economy that were expressed soon after the referendum. Although the UK has not performed particularly well, there hasn’t been the collapse in demand that some feared. But with the UK set to leave the EU in March

2019, nerves about the lack of detail surrounding the departure are sure to increase if no concrete progress is made in the early part of the year. While the market has been to some extent positively surprised by the robustness of the economy in the short term, the evidence from the data remains quite worrying, with exports apparently getting little boost from the weaker pound and investment seemingly being restricted by the uncertainty surrounding the issue. There are likely to be some pieces of positive news through 2018, with the possibility of a transition agreement being reached looking the most probable, and the market is expected to be volatile as a result. But Brexit is likely to have a net negative impact on the UK economy, especially in its early stages, and uncertainty and concerns about the issue will put the pressure back on the pound as 2018 progresses.

Europe and Japan – the tortoises catching up, but monetary policy still lagging behind

The 2008 financial crisis took a lot longer to have its full impact on the Eurozone than it did on the US, and it is only in the last couple of years that the Eurozone appears to be sustainably recovering from the impact of the crisis on its more fragile members. Through 2017 the Eurozone has consistently outperformed growth expectations, and it looks well placed to continue its relatively strong performance. Budgets are generally under control, the current account is in surplus and the currency remains at a very competitive level, despite the rise in 2017. Nevertheless, current forecasts do not suggest significantly above trend growth, and while the ECB looks set to taper its asset purchase program, there is no rate rise on the horizon as yet. After a year of outperforming the

Anglo-Saxon economies, Eurozone growth is expected to dip back below the US. The case for rising Eurozone yields is therefore still probably less clear than the case for rising yields in the US. However, if asset purchases are tapered from the beginning of 2018 and end by mid-year as most expect, the second half of the year could see the market start to look forward to a rate rise in early 2019, and this could start to have a more dramatic impact on European yields.

Something similar can be said about Japan. Although the Japanese economy is perceived as a perennial underperformer since the Nikkei crash in the early 1990s, growth per capita has actually been broadly similar to most developed nations in recent years, and recent Cabinet Office analysis suggests that the economy may now be producing above long term trend capacity, suggesting upward pressure on wages and prices may be about to emerge. However, forecasts from the IMF and OECD do not suggest strong growth in 2018, and at this stage asset purchases continue with the BoJ specifically aiming at restricting the rise in long term yields. So despite the more favorable growth story coming out of the “tortoise” economies, yield spreads may initially widen slightly in favor of the USD if forecasts and policies are as expected in 2018. However, as the year goes on there might be a sharp catch up if growth in Europe and Japan outperforms once again.

Valuation

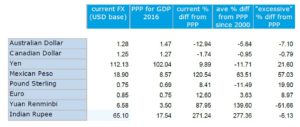

When considering the FX outlook over the longer term, it is always important to consider initial valuation. There are many methods to assess appropriate FX valuation, but the simplest factor, and the element that is included in all models of valuation, is relative inflation. Estimates of Purchasing Power Parity (PPP) for the major currencies indicate the relative cost of goods and services in each economy, and reflect the movements in prices over the years. Thus, the starting point for assessing relative valuation is to look at how currencies stand relative to PPP, and how that compares with historic performance. The table below does just that.

Source: OECD

The table requires some interpretation. It’s notable that the emerging market currencies are a long way below PPP, but also that they have consistently been so. This is normal, in that relative income levels play a large part in currency valuation in emerging markets. However, in developed markets this is a less important factor, with relative interest rates and current account positions typically having the biggest influence on deviations from PPP.

The notable stories from the table are that the USD is a little high relative to history against the EUR, JPY and GBP, which is well explained by a combination of relatively high US interest rates, fairly buoyant risk appetite and the uncertainties surrounding Brexit. The USD is slightly undervalued relative to history against the AUD and CAD, where interest rates are higher and which tend to benefit more from positive risk appetite. In the emerging markets the interesting story is the MXN. It is well known that the CNY has been steadily appreciating in line with the strong growth in the economy and the large current account surplus, so while still cheap relative to PPP, the CNY is much less cheap than it was. However, the MXN is extremely weak relative to history, explained largely by the impact of the Trump presidency and the perceived protectionist threat to Mexico, though MXN weakness had begun before the election of Trump.

Geopolitics – the perennial wildcard

We have seen periodic market reaction to North Korea in 2017, and this seems likely to continue to create sporadic shocks in the coming year. However, such impacts tend to be short-lived, and cannot be planned for. Clearly, if there were to be a major escalation, there could be a huge and sustained market impact, but in practice such outcomes are unmanageable, and the sensible assumption is that geopolitical events will not have a sustained impact, and represent buying opportunities for the more risky assets and currencies, if only because the alternative would be unpredictable as well as unthinkable.

Currency Outlooks

EUR/USD

Expected range 1.12-1.30. Bias – mildly bullish.

EUR/USD in 2017 – barring late accidents – has had its best year since 2007. The EUR has been supported by three main factors. First, its starting level was low as the immediate aftermath of Trump’s election saw general sharp gains for the USD in anticipation of a fiscal boost and a consequently more aggressive Fed tightening in response. The fading of such expectations led to steady USD losses. Second, the Eurozone itself performed better than most expected with growth solid through the year and inflation starting to edge higher, triggering comments from ECB president Draghi indicating that the threat of deflation had gone, and leading to expectations of tapering and eventual halting of ECB asset purchases in 2017. Third, the downside impetus that the EUR suffered after the Brexit vote has to some extent been reversed, helped by a recovery in GBP, but this remains a factor in the background.

For 2018 the markets will probably continue to discuss ECB tapering and the eventual ending of asset purchases, and with it the possibility of a rate hike in 2019. This suggests an upward bias to Eurozone yields which is likely to become more pronounced in the second half of the year if the economy continues to improve steadily. However, this has to be considered alongside the situation in the US, where there is likely to be some stimulus from fiscal policy, albeit less than had previously been hoped, and where the monetary tightening cycle is already in train and set to continue. With the Fed set to tighten further as well as sell back some bonds to the market, the risks May be weighted towards a widening of yield spreads in favor of the USD in the first half of the year.

However, although the USD may gain some support from widening yield spreads, its extent is likely to be quite modest, with the Eurozone economy still expected to perform well and the expectation of future policy tightening likely to help Eurozone yields rise only a little less than the US. The EUR will also gain support from the burgeoning current account surplus, now close to 4% of GDP, its still historically slightly low valuation, and the risks that rising yields trigger a setback for equity markets. This would tend to favor the currencies of surplus nations like the EUR, JPY and CHF. The combination of these factors suggests that the EUR will likely finish the year at or above current levels, though perhaps after an early year dip.

Source: Bloomberg

GBP/USD

Expected range 1.15-1.45. Bias – bearish.

Much of the talk about GBP through 2018 will be about Brexit and the preparations, though if a transitional agreement is made, as rumored, the Brexit issue might fall into the background in the short run. Such an agreement could effectively delay Brexit for two years or more, and would certainly be seen as GBP positive in the short term. In reality, it only delays the big decisions, and economists are broadly agreed that whatever the outcome it will be second best to EU membership and consequently justifies a weaker pound (compared to pre-Brexit levels just below $1.50). Alternatively, if we remain short on detail on the likely shape of Brexit or the transition deal well into

2018, GBP is likely to come under pressure. So Brexit is clearly a potential source of volatility, but calling the net GBP impact in 2018 is well nigh impossible given the huge uncertainty and wide variety of possible outcomes. On balance, we would expect it to prove net GBP negative over the year, though a transition deal is likely to be announced at some point, probably in the first half of the year (if not before the end of 2017), and that is likely to trigger a positive reaction, albeit possibly only for a few weeks.

However, GBP is also likely to be affected by the performance of the economy and the Bank of England’s monetary policy path. The latest comments from the Bank suggest they are likely to raise rates before too long, probably before the end of 2017, and this has provided GBP with some support already and would likely give it a further modest boost if the rate hike is delivered. But a modestly higher base rate wouldn’t really change GBP’s status as a low yielding currency, as relatively high UK inflation means that even with a 25bp rate hike, real short term yields in the UK are unattractive by international standards. The broader UK economic performance also leaves a lot to be desired, with growth struggling as consumers face negative real income growth, high debt levels and record low saving rates, while investment and exports are struggling under Brexit uncertainty, with net exports so far apparently receiving little benefit from the weak pound. So even though GBP is starting from still slightly cheap levels from a historical perspective, the risks seem mostly on the downside for 2018, though expect substantial volatility around Brexit news.

USD/CAD

Expected range 1.10-1.35. Bias – mildly bearish

There is relatively little of interest to say about USD/CAD compared to other pairs. The US and Canada now seem to have their economies and monetary policy cycles broadly in sync and valuation is basically fair so it’s hard to see a new trend building from current levels. If anything triggers a move it may well be the oil price, which could be biased higher if we have the synchronized global recovery implied by most forecasts, suggesting some potential for CAD strength. But with BoC governor Poloz indicating a near term monetary policy pause and the Fed now 97% priced for a December rate hike, it seems unlikely we will see any pronounced CAD strength will emerge in the short term.

USD/MXN

Expected range 17.00-20.00. Bias – bearish

The most notable thing about USD/MXN is the current valuation level. As can be seen from the table above and the chart below, the MXN looks very cheap by historic standards, having been propelled there by some protectionist speculation around the US election as well as general USD strength. However, the MXN recovery has been comparatively anemic, even though none of the major threats associated with the Trump administration appear to have been fulfilled. Going forward, there are still concerns surrounding NAFTA negotiations, and inflation and monetary policy will also remain a factor, In addition, there are elections in 2018 which seem likely to hinge on the shape of future relations with the US. These issues will sustain substantial uncertainty around the MXN. But the MXN is so very cheap that it would require worst case scenarios just to justify current levels. The MXN consequently looks to have substantial potential to appreciate through 2018. If it were to return to its average deviation from PPP since 2000 there would be scope for a move to somewhere close to 14.0! But given the uncertainties such a huge recovery is very unlikely. Nevertheless, merely a move back to the 17.00 area looks quite feasible and would still leave a substantial risk premium in the MXN.

Source: OECD

USD/JPY

Expected range 100-125. Bias – Mildly bullish on a central view, but significant downside risks

In the preferred scenario where the world continues to recover modestly, rates rise further in the US and asset markets remain well supported, USD/JPY looks likely to edge higher as is usually the case when risk appetite is buoyant and yield spreads are moving in the USD’s favor. But while this is the central view, there is a significant risk that the rising global interest rate profile will trigger a selloff in bond and equity markets which itself will trigger a sharp rise in the funding currencies, with the JPY chief among these. In addition, there is a risk that ultra-easy Japanese monetary policy is tightened up towards the end of the year if wages and prices start to respond to what the Cabinet Office regard as above trend output. USD/JPY is trading well above PPP, and while USD strength has been widespread in recent years, it is more unusual against the JPY than it is against other currencies, as the big Japanese current account surplus and positive international investment position has tended to mean the JPY trades on the strong side. As long as yield spreads favor the USD and risk appetite remains strong, this valuation issue is likely to remain in the background and the JPY is likely to weaken modestly. But risks of a sharp JPY recovery will increase as the year goes on the longer we go without a significant asset market correction.

USD/CNY

Expected range 6.00-6.80. Bias – mildly bearish

There is often a lot of excitement about moves in USD/CNY, but in reality this is not typically a volatile currency pair, with the PBOC keeping the market orderly. The PBOC target the CNY against a basket of currencies, and as can be seen from the chart below, it has generally strengthened around3% a year since the peg to the USD was released in 2005. Currently it is at the low end of where it might be expected to trade against the basket so looks likely to gain 3% or more against the basket in the coming year. 2018 looks to be a mildly bearish year for the USD, given that it is starting slightly overvalued against most currencies, even though there may be periods of USD strength, specifically if we see tighter Fed policy in reaction to more expansionary US fiscal policy. This suggests that the CNY will move up against the USD as well as appreciating against its basket. So by the end of the year USD/CNY could fall 5% to around 6.25, though if, as we suspect, the USD performs well in the early part of the year, there could be an initial edge higher towards 6.8.

Source:BIS

Compliments of Bannockburn Goobal Forex, a member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)