By Michael Molenaars | Jeroen Smits | Maarten de Bruin | Emile Bongers | Reinout de Boer | Robert Jean Kloprogge | Stibbe

On 19 September it was budget day (Prinsjesdag) in the Netherlands on which the Dutch government announced several bills containing tax law proposals. In this Tax Alert we will provide you with a summary of the main proposals relevant for international businesses. Most attention will be given to the proposal regarding changes to the Dutch dividend withholding tax rules for holding cooperatives and BVs/NVs.

It should be noted that following the general elections in the Netherlands earlier this year and in light of the ongoing coalition negotiations, the current government has not included new policy matters in the proposals since these have been left to the new government.

The following proposals will be addressed below:

1. Dutch dividend withholding tax rules for holding cooperatives and BVs/NVs

2. Amendment of rebuttal scheme included in anti-base erosion rules (article 10a CITA)

3. Prevention of double loss recognition (article 13d and 15ac CITA)

4. Amendment of participation exemption in reation to liquidation losses

5. Amendment of rules for the calculation of relief for double taxation in case of fees charged between companies included in a fiscal unity

6 . Abolishment of deemed employment relationship for non-executive directors of Dutch listed companies

The proposals will be debated before the Dutch parliament which may lead to amendments. It is expected that the proposals will be adopted by the First Chamber of Parliament mid-December and will enter into effect on 1 January 2018 (unless a different date has been included in the proposals).

1. Dutch dividend withholding tax rules for holding cooperatives and BVs/NVs

The legislative proposal regarding changes to the Dutch dividend withholding tax (“DWT”) rules for holding cooperatives and BVs/NVs (the “Legislative Proposal”) is largely in line with the DWT changes already announced in the letters of the Dutch Secretary of Finance to Dutch Parliament in September 2016 and December 2016 (discussed in our Tax Alerts of September 2016 and December 2016 ) and the draft legislative proposal published on 16 May 2017 (discussed in our May Tax Alert ).

However, the Legislative Proposal does contain some new aspects which may be very relevant to existing structures. We will discuss the scope and main features of the Legislative Proposal and its potential impact on Dutch (intermediary) holding structures below.

Scope of the Legislative Proposal

In relation to cooperatives, the starting point is that under the Legislative Proposal only distributions by holding cooperatives (a “Holding Cooperative“; as discussed in further detail below) to members that hold a qualifying participation in the Holding Cooperative will become subject to DWT at the standard 15% rate in the same way as distributions by limited liability companies such as the Dutch N.V. (naamloze vennootschap) and B.V. (besloten vennootschap), unless the proposed (broadened) exemption from DWT applies.

The DWT exemption will apply to qualifying participations in Holding Cooperatives and limited liability companies that are part of an active business enterprise of the shareholder/member and/or not considered abusive, provided that the shareholder/member is located in an EU/EEA or tax treaty jurisdiction. Shareholders/members located in jurisdictions that are not EU/EEA jurisdictions and with which the Netherlands has only concluded a treaty on the exchange of information or a treaty that does not contain a dividend provision, do not qualify for purposes of the proposed DWT exemption.

Dutch Holding Cooperative and qualifying participations

A Holding Cooperative is defined as a cooperative whose activities mainly (for 70% or more) consist of the holding of participations and/or the direct or indirect financing of affiliated persons or entities. Therefore, distributions by cooperatives the activities of which consist of more than 30% of other activities than holding participations in subsidiaries or directly or indirectly financing related parties would not be subject to DWT. Under the Legislative Proposal, a cooperative with real economic activities should not be affected by the new rules. Therefore, distributions by these cooperatives to their members should not become subject to DWT.

In determining whether a cooperative qualifies as a Holding Cooperative, the activities conducted by the cooperative in the 12 months preceding the profit distribution will be decisive. Although this test is in principle based on the cooperative’s balance sheet total, other factors – such as the assets, liabilities, turnover and the nature of activities conducted by employees – may also be taken into account. For example, a cooperative whose balance sheet total consists of 70% of participations may still not qualify as a Holding Cooperative if it performs a headquarter function with active involvement and sufficient employees. This may also apply in respect of cooperatives used in certain private equity structures with sufficient employees at the level of the cooperative and active involvement at the level of the participations of the cooperative. To establish whether or not a cooperative qualifies as Holding Cooperative, the cooperative can proactively engage the Dutch Tax Authorities and seek (advance) clearance on its Dutch DWT qualification.

A qualifying participation in a Holding Cooperative is a membership interest that entitles the holder thereof to at least 5% of the Holding Cooperative’s annual profit or 5% of the liquidation proceeds. In determining whether a member has a qualifying participation, participations in the Holding Cooperative directly or indirectly held by parties related to such member or by other entities that are part of the same cooperating group of such member are also taken into account.

DWT exemption for shareholders/members in tax treaty jurisdictions

Under the Legislative Proposal, the scope of the current DWT exemption for EU and EEA shareholders will be extended to shareholders/members that are located in a tax treaty jurisdiction, provided that the tax treaty contains a dividend provision. The shareholder/member should in principle be a treaty resident (i.e. not tax transparent in the treaty jurisdiction), but not meeting, for example, the LOB requirements or the requirements of the dividend provision in the treaty should in principle not affect application of the exemption.

However, in contrast to the draft proposal of May 2017 the Legislative Proposal provides that if the shareholder/member is a so-called hybrid entity (i.e. transparent in one country and opaque in the other country), the DWT exemption may still apply provided certain conditions are met. One of the most common examples is the US LLC. Such hybrid entity is typically considered opaque from a Dutch tax perspective and transparent from a US tax perspective. Under the Legislative Proposal, provided that each shareholder of the US LLC would have been individually entitled to the DWT exemption had it held the qualifying participation in the Dutch company/Holding Cooperative directly and provided further that the relevant item of income distributed by the Dutch company/Holding Cooperative is treated as (taxable) income for the shareholder of the US LLC in the US, the Dutch domestic DWT exemption applies and the shareholders of the US LLC would no longer have to rely on the double tax treaty between the US and the Netherlands in order to be eligible for a reduction or exemption from 15% Dutch DWT.

The DWT exemption will be subject to new anti-abuse rules that are based on the current Dutch corporate income tax (“CIT“) anti-abuse rules for foreign taxpayers that hold a qualifying shareholding/membership interest in a Dutch resident company/cooperative (see below), with some additional features including the introduction of a principal purpose test (as provided for under OECD BEPS Action 6). As these rules will in principle be based on the existing Dutch CIT anti-abuse rules, the Legislative Proposal indicates that effectively there should be no departure from the current practice.

Under the anti-abuse rules provided for in the Legislative Proposal, the DWT exemption is denied if (i) the shareholder/member holds the shareholding/membership interest with the main purpose or one of the main purposes of avoiding Dutch DWT in the hands of another person (the subjective test) and (ii) there is an artificial structure or transaction or a series of artificial arrangements or transactions (the objective test).

For the application of the subjective test it will have to be assessed whether the direct shareholder of the Dutch company/Holding Cooperative has been interposed, with the main purpose or one of the main purposes to avoid DWT in the hands of another person. If so, the DWT exemption does not apply, unless the shareholder qualifies under the objective test (see below).

Under the objective test, it needs to be determined whether there is an artificial structure, transaction or a series of artificial arrangements or transactions that have not been put in place for valid commercial reasons reflecting economic reality. Valid commercial reasons (reflecting economic reality) are generally present if the direct shareholder conducts a business enterprise to which the interest in the Dutch company is attributable. If the direct shareholder/member of the Dutch company/Holding Cooperative is an intermediary holding company, valid commercial reasons are present if the intermediary holding company (i) performs a “linking function” between its shareholder that conducts the active business enterprise and the Dutch company/Holding Cooperative and (ii) meets the new relevant substance requirements in the jurisdiction where it is located.

The new relevant substance requirements are inspired on the existing Dutch minimum substance requirements. The first addition to the existing substance requirements is that the intermediary holding company will need to incur wage costs of at least EUR 100,000 (or a lower amount if such amount is considered more appropriate under local standards) for employees that perform the linking function at the level of the intermediary holding company. The employees may be hired from group companies (whereby the relevant wages may be allocated to the intermediary holding company through a salary split arrangement), while they need to perform their activities in the jurisdiction where the intermediary holding company is established. The second addition is a substance requirement under which the intermediary holding company will need to have its own office space at its disposal in the jurisdiction where it is established during a period of at least 24 months which requires this office space to be equipped and used for the linking function. The two new substance requirements will apply from 1 April 2018.

In relation to the existing minimum substance requirements, we note that for practical reasons neither the requirement that the participation in the Dutch company/Holding Cooperative is financed with at least 15% of equity nor the requirement that the intermediary holding company complies with all of its tax filing obligations in its jurisdiction of establishment are required to be satisfied given that it is not feasible from a practical perspective for the Dutch tax authorities to verify whether these conditions have been met.

Dutch dividend withholding tax treatment of repayments of capital/members contributions

Under the current DWT rules for Dutch cooperatives – if they are subject to DWT – repayments by Dutch cooperatives of contributions made by their members on the membership accounts are subject to DWT whereas repayments of paid-in capital by Dutch BVs or NVs may be exempt from Dutch DWT. The reasons for this distinction is that Dutch cooperatives do not have a nominal share capital and therefore cannot benefit from the special rule that (partial) repayments of paid-in capital are not subject to DWT if, for example, the nominal value of the shares concerned has been reduced by a corresponding amount by way of an amendment of the articles of association. Under the Legislative Proposal, the DWT act will explicitly provide that repayments by Holding Cooperatives of members contributions are not subject to DWT either.

Information reporting obligations

In order for the Dutch tax authorities to be able to verify whether the recipient of a distribution is indeed entitled to the DWT exemption, the Dutch tax authorities will require the distributing company/Holding Cooperative to provide them with information to enable them to ascertain whether the DWT exemption has been applied correctly. In addition, the distributing Dutch company/Holding Cooperative will have to confirm to the Dutch tax authorities that the conditions for application of the DWT exemption have been satisfied. The information has to be provided within one month of the date of the dividend distribution, which is the same period within which the Dutch DWT return has to be filed. Failure to comply with this information reporting obligation could result in penalties of up to EUR 5,278.

Dutch corporate income tax anti-abuse rules

Under the current Dutch domestic corporate income tax anti-abuse rules, dividends and capital gains derived by a foreign shareholder/member from a substantial interest (generally a shareholding/membership interest of 5% or more) are subject to Dutch CIT if the following two cumulative conditions are met (i) the shares/membership rights are held by the foreign shareholder/member with the main purpose of avoiding Dutch personal income tax or dividend withholding tax in the hands of another person (anti-abuse test) and (ii) there is an arrangement or a series of arrangements that have not been put into place for valid commercial reasons reflecting economic reality (the objective test).

Under the Legislative Proposal, the test under (i) will be amended such that it will only apply if Dutch personal income tax is avoided (the rationale for this being that the avoidance of DWT is addressed in the new DWT anti-abuse rules). However, in contrast to the draft proposal of May 2017, which provided that dividend distributions would not be subject to 25% Dutch CIT if the Dutch CIT anti-abuse rules apply (but solely subject to Dutch DWT), the Legislative Proposal provides that these dividends will continue to be subject to 25% Dutch CIT because otherwise the 25% Dutch CIT on capital gains could easily be avoided by making dividend distributions that are subject to 15% Dutch DWT instead. Please note that in these circumstances the 15% DWT would function as a pre-levy towards the 25% Dutch CIT and could thus be credited against the Dutch CIT liability of the foreign shareholder/member.

Impact on international holding structures

Based on the Legislative Proposal, under Dutch domestic DWT rules distributions by Holding Cooperatives to members in non-treaty jurisdictions such as the Cayman Islands, BVI, etc. will in principle become subject to 15% DWT (and perhaps even subject to 25% Dutch CIT) from 1 January 2018. In these types of situations, a restructuring of the participations held in the Holding Cooperative before 1 January 2018 should be considered.

In addition, under Dutch domestic rules distributions to intermediary holding companies in EU/EEA/tax treaty jurisdictions such as Luxembourg or the UK may in principle also become subject to 15% DWT from 1 January 2018, unless the DWT exemption applies. Application of the DWT exemption requires that these intermediary holding companies satisfy the new relevant substance requirements. In existing intermediary holding structures that satisfy the existing Dutch minimum substance requirements, this means that the EUR 100,000 wage and 24 month office space substance requirements will also need to be satisfied. If the DWT exemption is not applicable, then the DWT may still be mitigated under a tax treaty (as long as it doesn’t contain an anti-abuse provision).

By their terms tax rulings will in principle terminate from 1 January 2018 if the intermediary holding company does not meet the relevant substance requirements on such date. However, in these tax ruling situations the tax ruling will not terminate from 1 January 2018 if the two additional substance requirements (e.g. wage costs and office space) are met before 1 April 2018.

The good news is that the extension of the DWT exemption to qualifying participations directly or indirectly held by shareholders/members with an active business enterprise that are located in tax treaty jurisdictions improves the position of such shareholders/members. This will, among other things, be the case where the treaty does not provide for a full exemption from Dutch DWT, such as the tax treaties with Canada or the PRC that only provide for a reduction of the Dutch DWT to 5%, or where the treaty provides for extensive limitation on benefits provisions, such as the tax treaties with the US and Japan. In both cases, the DWT exemption would apply irrespective of the tax treaty rate. Furthermore, the position of US LLCs will likely improve as well given that their US shareholders may become eligible for the Dutch domestic DWT exemption and would no longer have to rely on the double tax treaty between the US and the Netherlands in order to benefit from a reduction or exemption from Dutch DWT.

2. Amendment of rebuttal scheme included in anti-base erosion rules (article 10a CITA)

The anti-base erosion rules (article 10a CITA) provide that interest expenses and fluctuations in value in respect of loans de jure or de facto, directly or indirectly, owed to related entities or related individuals are not deductible, to the extent these loans de jure or de facto, directly or indirectly, relate to a “tainted” transaction (such as dividend distributions, capital transactions and/or certain acquisitions) unless one of the following rebuttal schemes is applicable:

*Both the intra-group debt financing and the underlying “tainted” transaction (for which the debt is incurred) are predominantly motivated by sound business reasons (“double business motive test”); or

*The interest on the loan is sufficiently taxed (at least 10%) and determined under Dutch tax rules in the hands of the recipient (which does not have loss carry forwards at its disposal), unless the tax inspector substantiates that despite the 10% tax the debt or related transaction is not driven by business motives (“subject to tax test”).

With respect to the ‘double business motive test’ the Dutch Supreme Court (Hoge Raad) ruled on 21 April 2017 that a taxpayer meets this test if it can demonstrate that the intra-group debt owed to a related party is de facto owed to a third (unrelated) party (i.e. the internal debt is funded by external debt under equal so-called ‘parallel’ loan conditions), irrespective of whether the taxpayer is able to demonstrate that the transaction for which the debt was incurred is driven by sound business reasons. In other words, the double test was effectively reduced to a single test. According to the Ministry of Finance, the interpretation by the Supreme Court of the double business motive test of article 10a CITA differs from the application by the Dutch tax authorities of the test in practice whereby the Dutch tax authorities assessed the business motive of the underlying transaction separately from the business motive of the intra-group debt financing.

Scope of the amendment

The government therefore proposes to “clarify” the wording of the double business motive test to ensure that if the tax payer is able to demonstrate that the intra-group debt is effectively an external debt (and thus motivated by sound business reasons), the underlying “tainted” transaction should still be based on its own sound business reasons.

At this moment, no grandfathering rules are proposed which means that the double business motive requirement will as from 1 January 2018 also apply to loans granted before such date.

According to the explanatory memorandum to this legislative proposal, this amendment should not affect the assessment of whether a debt is de facto owed to a third party (i.e. the internal debt is funded by external debt under equal loan conditions) and that the relevant criteria mentioned in the Supreme Court decision of 21 April 2017 to determine if loans are parallel (such as duration, maturity repayment schedule, interest rate, time of issuance), remain relevant in that respect.

3. Prevention of double loss recognition (article 13d and 15ac CITA)

On 27 September 2016, a Dutch member of parliament called upon the government to make double loss recognition outside a CIT fiscal unity (fiscale eenheid) but within a group of tax payers via a write down of debt impossible. In line with earlier statements from the government, it is now proposed to amend the law accordingly.

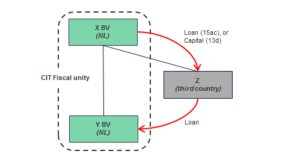

The current wording only prevents double loss recognition on loans granted to companies which are or were part of the same CIT fiscal unity as the taxpayer but not via related companies. For example, in the following situation a double loss recognition may be applicable:

If Y BV is in a loss-making position, the losses of Y BV can be offset against the profits of X BV (due to the CIT fiscal unity regime) (first recognition). However, as a result of the negative results of Y BV the loan granted by Z to Y BV may be depreciated and consequently X BV may also depreciate its loan granted to Z (second recognition). If X BV funded Z with capital, the same in principle applies for a liquidation loss to be incurred by X BV as a result of the liquidation of Z.

The proposed amendment provides that double loss recognition (as described above) will be made impossible in the future also for situations whereby Z is a related party (i.e. related via an interest of 1/3rd or more).

4. Amendment of participation exemption in relation to liquidation losses (art. 13d CITA)

Under the participation exemption regime, dividend income and capital gains on qualifying shareholdings are exempt from the Dutch corporate income tax base. Capital losses on such shareholdings are non-deductible. However, subject to certain requirements, upon the completion of the liquidation of a company, a so-called liquidation loss is deductible (which is broadly speaking the difference between the so-called invested amount and liquidating distributions, subject to several adjustments).

The proposed amendment of the liquidation loss rules responds to a decision of the Court of Den Bosch (20 October 2016) in a case that involved the rather technical application of the liquidation loss rules in the event of the liquidation of an intermediary holding company that was previously included in a fiscal unity (the Dutch tax grouping regime). The Court ruled that in spite of the permissive wording of the law, based on its object and purpose, the invested amount of the intermediary holding should be based on the (lower) fair value of the shareholdings held by the intermediary holding company (instead of the higher historical cost price). Due to this lower invested amount, no liquidation loss was present. Responding to a recommendation by the Court, the government now proposes to amend the wording of the law to better express the object and purpose of the liquidation loss rules.

5. Amendment of rules for the calculation of relief for double taxation in case of fees charged between companies included in a fiscal unity (art. 15 CITA)

In its ruling of 3 June 2016, the Dutch Supreme Court ruled that, for the calculation of tax exempt income of a permanent establishment, royalties charged by one company included in a fiscal unity to another company included in that fiscal unity, which are allocated to a permanent establishment (“PE“) of the latter company, should be ignored. The royalty fees are ignored due to the nature of the Dutch fiscal unity regime under which intra-fiscal unity transactions are disregarded. If the jurisdiction in which the PE is located, upon calculating the income of the PE, does take the royalties into account, the PE-income that is taxed in the PE-jurisdiction is lower than the tax exempt PE income calculated. To counter this undesired effect, the rules for calculating the tax exempt PE-income of a company included in a fiscal unity “will be amended.

In fact, in an earlier case (“Sarakreek”) the Supreme Court issued a similar ruling in relation to intra-fiscal unity interest charges. That ruling eventually led to the addition of a provision to the fiscal unity regime that provides that just for the calculation of the relief for double taxation, the fiscal unity is disregarded. The scope of this provision is now proposed to be extended to include intra-fiscal unity royalty charges.

6. Abolishment of deemed employment relationship for non-executive directors of Dutch listed companies

At present, a director of a Dutch listed company is deemed to be in an employment relationship for Dutch wage tax and social security purposes. Consequently, a Dutch listed company will need to (i) withhold Dutch wage tax/national insurance premiums from and (ii) in principle pay certain (non-recoverable) Dutch employee insurance premiums on, the remuneration paid to its directors.

The government proposes to abolish the deemed employment relationship for Dutch wage tax and social security purposes for non-executive directors in a one-tier board of a Dutch listed company. Consequently, a Dutch listed company will no longer (i) have to include non-executive directors in its Dutch payroll administration and (ii) be obliged to withhold and/or pay Dutch wage tax and social security premiums in respect of the remuneration paid to non-executive directors. As a result, non-executive directors will be treated the same as supervisory board members in a two-tier board for which the deemed employment relationship for wage tax purposes was already abolished on 1 January 2017.

Going forward, a non-executive director will therefore need to file a tax return for Dutch personal income tax, national insurance premiums and the income-dependent health insurance contribution after the end of each calendar year. The abolishment of the deemed employment relationship also has other effects such as the application of benefits that require payment through a Dutch payroll administration, for example, the application of the 30%-ruling (which can no longer be applied).

For sake of completeness, it is noted that the 2018 Budget does not change the treatment of other directors for Dutch wage tax/socials security purposes:

*executive directors of a Dutch listed company are in a deemed employment relationship;

*executive directors of a Dutch non-listed company are in an employment relationship; and

*non-executive directors of a Dutch non-listed company are not in a(n) (deemed) employment relationship.

Whether a director of a company is considered a(n) executive or non-executive director can be derived from the Dutch Trade Register.

Compliments of Stibbe, a member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)