On March 6, 2024, the SEC adopted its long-awaited climate disclosure rules. Below are ten things about the final rules that public companies should be aware of:

Relaxed Scope 1 and Scope 2 Greenhouse Gas (GHG) Emissions Disclosure and Attestation Requirements

The final rule requires larger companies with material Scope 1 emissions (direct GHG emissions) and Scope 2 emissions (indirect GHG emissions resulting from purchased energy) to provide certain information regarding such emissions, including, among other things, the methodology, significant inputs and significant assumptions used to calculate such emissions. Such companies will also be required to include an attestation report covering such disclosures, as well as certain information regarding the attestation provider.

o Versus the proposed rules: Under the proposed rules, all companies were required to provide Scope 1 and Scope 2 disclosures, while the final rule removes the mandatory reporting requirement and limits disclosures to material emissions.

o SRCs, EGCs and NAFs exempt: Smaller reporting companies, emerging growth companies and non-accelerated filers are exempt from the emissions disclosure requirements.

o Incorporating by reference from future filing: Where companies are required to provide emissions disclosures in their Form 10-K, they may instead incorporate such disclosures by reference from their second quarter Form 10-Q for the following fiscal year or in an amended Form 10-K filed no later than the due date for such Form 10-Q.

Scope 3 GHG Emissions Reporting Requirements Eliminated

The SEC initially proposed that companies would be required to disclose information regarding their Scope 3 emissions (all other indirect GHG emissions occurring in a company’s value chain, both upstream and downstream) in certain instances. However, after significant pushback from stakeholders, who argued, among other things, that Scope 3 disclosure data would be difficult to produce and could be subject to litigation risk, the SEC removed the Scope 3 disclosure requirement from the final rule.

Climate-Related Risk Disclosures

Companies are required to disclose climate-related risks that are reasonably likely to have a material impact on them, including their business strategy, results of operations,

or financial condition, including, among other things, whether such risks are reasonably likely to occur in the short-term (within the next 12 months) or long-term; whether risks are physical or transition risks; the actual and potential material impacts of such risks on their strategy, business model and outlook; and how such risks have materially impacted, or are reasonably likely to materially impact, their business, results of operations or financial condition. In addition, if a company has undertaken activities to mitigate or adapt to climate-related risks, it is required to provide a quantitative and qualitative description of any material expenditures incurred and any material impacts on

financial estimates and assumptions that directly resulted from such mitigation or adaptation activities

Climate-Related Targets and Goals, Transition Plans, and Scenario Analyses

Companies are required to disclose any climate-related targets or goals that have materially affected, or are reasonably likely to materially affect, their business, results of operations or financial condition, including, among other things, the scope of activities included in the target or goal, the unit of measurement, any baseline, and how they

intend to meet such targets or goals, as well as progress made toward meeting such targets or goals. Companies are also required to provide additional information if any carbon offsets or renewable energy credits (RECs) were used as a material component of their plan to achieve such targets or goals. In addition, companies are required to provide certain information regarding transition plans, scenario analyses, or internal carbon prices they have adopted or used.

Risk Governance and Management Disclosures

Companies are required to describe: o the board’s oversight of climate-related risks, including, for companies required to disclose climate-related targets or goals or transition

plans, whether and how the board oversees progress against such targets, goals or plans:

o management’s role in assessing and managing material climate-related risks, including responsible management positions and their relevant expertise (for example, prior work experience in climate-related matters, any relevant degrees or certifications, and any knowledge, skills, or other background in climate-related matters); and

o their processes for identifying, assessing, and managing material climate-related risks, including whether and how such processes are integrated into their overall risk management system or processes. The proposed requirement to disclose whether any board members have expertise in climate-related risks was not included in the final rule.

Climate-Related Disclosures in Financial Statements

While the final rule added disclosure requirements relating to expenses, costs and recoveries resulting from severe weather events and other natural conditions, which are required to be included in the notes to the audited financial statements, the final disclosure requirements are overall less burdensome than those proposed and are focused on a “discrete set of actual expenses that [companies] incur and can attribute to severe weather events and other natural conditions.” Required disclosures include the following:

o The aggregate amount of expenditures expensed as incurred and losses, excluding recoveries, incurred during the fiscal year as a result of severe weather events and other natural conditions, if the aggregate equals or exceeds 1% of the absolute value of income (loss) before income taxes for the relevant fiscal year, unless the aggregate is less than $100,000 for the relevant fiscal year.

o The aggregate amount of capitalized costs and charges, excluding recoveries, incurred during the fiscal year as a result of severe weather events and other natural conditions, if the aggregate equals or exceeds 1% of the absolute value of stockholders’ equity (deficit) at the end of the relevant fiscal year, unless the aggregate is less than $500,000 for the relevant fiscal year.

o If companies are required to provide disclosures under either of the bullets above, they are also required to separately state the aggregate amount of any recoveries recognized during the fiscal year as a result of severe weather events and other natural conditions for which capitalized costs, expenditures expensed, charges, or losses are disclosed.

o Companies are also required to provide certain information regarding carbon offsets or RECs used as a material component of their plan to achieve their disclosed climate-related targets or goals.

Elaborate Internal Controls Required

Companies will require elaborate internal controls in connection with the new rules, which could be difficult and costly to adopt and implement. In addition, companies that

determine they are not required to report certain information under the rules, such as material climate risks or expenditures, will still need to implement controls and systems in order to make such determination.

Expensive to Implement

Adopting the new rules will likely be expensive, in terms of both hours and money spent to prepare relevant SEC filings, with an estimated increase in the external costs of being a public company of around 21%. The SEC estimated an average internal burden hour increase per affected respondent of over 1,000 hours for all affected filers and an

average professional cost increase per affected respondent of $167,250 for large accelerated filers, $165,389 for non-exempt accelerated filers and $150,028 for SRCs, EGCs and non-accelerated filers.

Where to Disclose

Part or all of the new climate disclosures are required in Form 10-K filings, under Part II, Item 6. Climate-Related Disclosure; Form 10-Q filings under Part II, Item 1B. Climate-Related Disclosure; and in certain registration statements, including Forms S-1, S-3, S-4, and S-11. For Form 10-K filings, if the relevant disclosure is included in other parts of the report, such as the risk factors or MD&A, companies may crossreference such disclosures in Item 6. In addition, the new disclosures are required to be tagged in iXBRL.

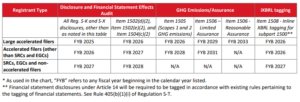

Phased-In Compliance Periods

The final rule includes phased-in compliance dates based on filer status, with the earliest filing requirements beginning in 2026*:

For more information, please contact Thompson Hine’s ESG Collaborative or Securities, Capital Markets & Corporate Governance team.

Compliments of Thompson Hine – a member of the EACCNY.

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)