What happened?

Since the Trump administration’s July 7 announcement delaying implementation of reciprocal tariffs from July 9 to August 1, the United States has reached preliminary framework trade agreements with the European Union (EU), Japan, Indonesia, and the Philippines (see PwC’s Tax Insights dated July 11, July 18, and July 30). Preliminary trade agreements with China and Vietnam also have been reached and a trade agreement with the United Kingdom has been finalized. Following the release of our July 30 Tax Insight, President Trump has taken additional steps, releasing executive orders, fact sheets, and presidential proclamations related to copper, new tariff rates for Brazil, suspension of the de minimis exemption, new reciprocal tariff rates, updates on Canada and Mexico trade talks, and additional tariffs for India. President Trump on July 30 also announced that a preliminary trade deal had been reached between the United States and South Korea.

In addition, President Trump has commented on agreements between the United States and Pakistan, Cambodia, and Thailand. PwC will address these potential agreements in a future Tax Insight once more details are available.

Why is it relevant?

The recent wave of executive actions marks a significant intensification of efforts to advance the

administration’s trade agenda. With country-specific rates now in place for more than 60 jurisdictions and new compliance requirements affecting even low-value shipments, multinational businesses are facing a substantially more complex and costly global trade environment.

Actions to consider

Tax and trade professionals should assess the impact of these measures on existing supply chains, especially for goods sourced from countries now subject to elevated tariffs or stricter customs treatment. Businesses may need to re-evaluate country-of-origin strategies, confirm eligibility under USMCA, and consider mitigation tools, such as first-sale for export valuation, tariff engineering, bonded warehouses, or foreign-trade zones. Companies heavily reliant on de minimis thresholds may be particularly exposed and should explore alternative sourcing or restructuring options to manage potential duty increases and compliance risks. For companies that already have considered mitigation strategies, now is the time to determine whether implementing these strategies is warranted.

In detail

The developments summarized below address the latest actions taken by the Trump administration, as well as high-level observations and revised projections of annual tariff impact.

US-South Korea preliminary trade agreement

On July 30 President Trump and South Korean President Lee Jae Myung announced a preliminary trade agreement between the United States and South Korea. Under the terms of the agreement, the United States will impose a tariff rate of 15%, down from the previously proposed 25% tariff rate. In return, South Korea agreed to invest $350 billion in US-owned strategic sectors selected by the President and to purchase $100 billion in American energy products, including liquified natural gas. South Korea also agreed to open its market to US goods, including automobiles, agricultural products, and other manufactured items, on similar terms as those offered to other key trading partners.

Observation: The imposition of a 15% tariff on South Korean automobiles marks a significant shift from the previous zero-duty status under the US–Korea Free Trade Agreement. This may affect pricing strategies and potentially spur reconsideration of localized manufacturing. In the consumer goods sector, selected household appliances and electronics, particularly premium categories, will face new duties, possibly reducing their price competitiveness.

Executive action on copper tariffs

President Trump issued a Proclamation on July 30 declaring that imports of copper on semi-finished and derivative copper products pose a threat to US national security due to excessive import volumes, overcapacity abroad, and the erosion of domestic production capabilities. The Secretary of Commerce’s Section 232 investigation found that copper is essential for defense systems — e.g., aircraft, vehicles, ships, submarines, missiles, and ammunition — and vital to broader industrial and infrastructure sectors. The White House Fact Sheet issued on July 30 also highlights that US refining and smelting capacity has sharply declined amid unfair foreign competition and state-sponsored overproduction, leaving the country overly reliant on imports. As a result, effective August 1, a 50% ad valorem tariff is imposed on select copper-intensive semi‑finished and derivative products, with the tariff assessed exclusively on the copper content of the imported good. Raw materials such as copper ores, concentrates, mattes, anodes, cathodes, and scrap are excluded from the tariff. Importantly, the White House fact sheet specifies that the tariffs do not stack with other duties, i.e., if a product is subject to another Section 232 action — such as for automobiles — only that tariff applies, not the Section 232 tariff on copper.

Observation: The imposition of a high, uniform tariff on copper-intensive products may create sudden cost increases for importers and downstream manufacturers, particularly in sectors where copper is a key input — e.g., construction, electrical equipment, transportation, and infrastructure. Companies should revisit existing sourcing strategies and landed cost assumptions, especially where imported components may contain significant copper content. The availability of a product inclusion process, as well as potential export licensing requirements for US-origin scrap and inputs, adds complexity to trade flow management. Businesses may benefit from proactively reviewing Harmonized Tariff Schedule (HTS) classifications, leveraging tariff engineering opportunities, or exploring duty deferral programs to help manage the operational and financial impact of this policy shift.

US imposes emergency tariffs on Brazil

President Trump has formally invoked emergency powers to declare that recent policies and actions by the Government of Brazil constitute an “unusual and extraordinary threat” to US national security, foreign policy, and economic interests, including violations of free speech and political persecution. In response, the Trump administration has imposed an additional 40% ad valorem tariff on Brazilian imports, bringing the total duty to 50%, effective one week after the executive order, while carving out exemptions for select goods such as orange juice, fuel, and fertilizers, as detailed in Annex I of the July 30 Executive Order and Fact Sheet. This measure is intended to reinforce the administration’s commitment to defending US companies, protected speech rights, and democratic values abroad through calibrated trade enforcement backed by legal authority under the International Emergency Economic Powers Act (IEEPA) and the National Emergencies Act.

Observation: The 50% tariff on select Brazilian imports, imposed under emergency authorities, may significantly affect cost structures for companies sourcing from Brazil. While certain sectors benefit from exemptions, businesses should reassess country-of-origin exposure, and consider tariff mitigation strategies where feasible. Importers also should monitor evolving enforcement trends tied to foreign policy measures.

Duty-free de minimis exemption suspended

President Trump issued an Executive Order on July 30 suspending duty‑free “de minimis” treatment under 19 U.S.C. Section 1321(a)(2)(C) on a global basis, eliminating the longstanding exemption that allowed commercial imports under $800 to enter the United States duty‑free. The policy, which previously was limited to China and Hong Kong, will now be applicable for all jurisdictions, effective August 29. Under the new framework, most low‑value shipments will be subject to full applicable duties, taxes, fees, and customs filing obligations, unless transported via the international postal network. For postal packages, a temporary specific duty ranging from $80 to $200 per item will apply for the first six months; thereafter, duties will shift entirely to ad valorem rates based on country of origin. The Trump administration justified the measure by invoking national emergencies around synthetic opioid trafficking and large trade deficits, asserting that de minimis shipments accounted for the majority of narcotics seizures and posed national security and economic risks.

Observation: Companies, particularly those in the e-commerce space, should prepare for significant cost increases and customs compliance burdens.

Revised reciprocal tariff rates announced

The White House issued an Executive Order on July 31 updating the United States’ reciprocal tariffs under the previously declared national emergency on trade deficits. The order establishes a new country- specific tariff schedule (Annex I), effective August 7, setting ad valorem rates ranging from 10% to 41%.

Note: While this executive order raises reciprocal tariff rates up to 41%, a separate executive order targeting Brazil increases rates up to 50%, as mentioned above. For countries not listed in Annex I, a baseline 10% tariff remains in force.

Observation: The revised reciprocal tariff rates mark a significant shift in how the United States structures trade relationships, tying reduced tariff rates directly to strategic alignment and negotiated commitments. The revised schedule signals the administration’s intent to apply sustained pressure on trading partners through differentiated rates while rewarding countries that engage in economic cooperation and investment. Multinational companies should evaluate how these country-specific changes may influence sourcing strategies, regional pricing models, and trade compliance planning in the months ahead.

Tariff adjustment on Canadian Imports

President Trump issued a new Executive Order and supporting Fact Sheet on July 31, raising the ad valorem tariff on Canadian imports from 25% to 35%, effective August 1, under emergency powers granted under IEEPA. However, if US Customs and Border Protection determines that goods are transshipped with the intent to avoid the 35% tariff, the executive order and fact sheet states that the goods “will be subject, instead, to a transshipment tariff of 40%”, per the fact sheet. President Trump cited persistent failures by Canadian authorities to interdict fentanyl and other illicit drugs flowing across the northern border, described as part of a public health emergency and threat to national security. The fact sheet explicitly links the tariff increase to Canada’s insufficient cooperation in arresting traffickers, seizing narcotics, and coordinating with US law enforcement. The Trump administration frames the measure as necessary and proportional to confront an “unusual and extraordinary threat” posed by illicit drug volumes entering the United States from Canada.

Observation: Companies with Canadian supply chains should reassess their import cost structures and compliance exposure following the increase in tariffs on Canadian goods. While USMCA-eligible imports remain duty-free, goods transshipped to circumvent the tariff could trigger a 40% tariff, making it critical to validate country-of-origin documentation and routing integrity to avoid costly reclassification or enforcement actions.

US and Mexico extend trade talks

The United States and Mexico have agreed to a 90-day extension of their current trade arrangement, temporarily delaying new tariffs while preserving existing measures, including a 25% general tariff on non-USMCA-compliant goods, 50% tariffs on steel, aluminum, and copper, and a 17% antidumping duty on Mexican tomatoes. The US administration has framed these tariffs as critical leverage in ongoing negotiations, citing the need for stronger cooperation on narcotics enforcement and the elimination of non-tariff barriers as key conditions for a longer-term trade framework.

Observation: Companies engaged in US–Mexico trade should be aware that while new tariffs are temporarily delayed, existing high-duty rates, up to 50% on certain metals and 25% on non-USMCA goods, remain in place during the 90-day extension. Companies should monitor negotiations closely and consider contingency planning, particularly in sectors vulnerable to further tariff escalation or new non- tariff compliance obligations.

Additional tariff imposed on India

In response to continued Russian aggression in Ukraine, President Trump declared a national emergency and issued an Executive Order and Fact Sheet on August 6, imposing an additional 25% tariff on imports from India, effective August 27. The action targets India’s ongoing importation (directly or indirectly) of Russian oil, which the administration argues undermines US foreign policy and strengthens Russia’s economic capacity to wage war. The tariff applies in addition to existing duties, including the 25% reciprocal tariff imposed under the April 2 Executive Order. The order provides for exclusions explicitly addressed under prior orders. The measure signals a broader effort to penalize countries supporting Russia’s energy sector and is positioned as a deterrent against indirect funding of Russian aggression, with further potential tariffs under review for other nations engaging in similar trade behavior.

Observation: The additional 25% tariff on Indian imports may significantly impact US industries reliant on Indian goods — e.g., pharmaceuticals, textiles, and specialty manufacturing — by raising input costs and disrupting supply chains. Companies in the energy and chemical sectors that source materials or refined products indirectly linked to Russian oil also may face compliance risks and cost volatility.

Businesses should evaluate sourcing strategies and prepare for potential ripple effects if tariffs expand to other countries.

Tariff impact

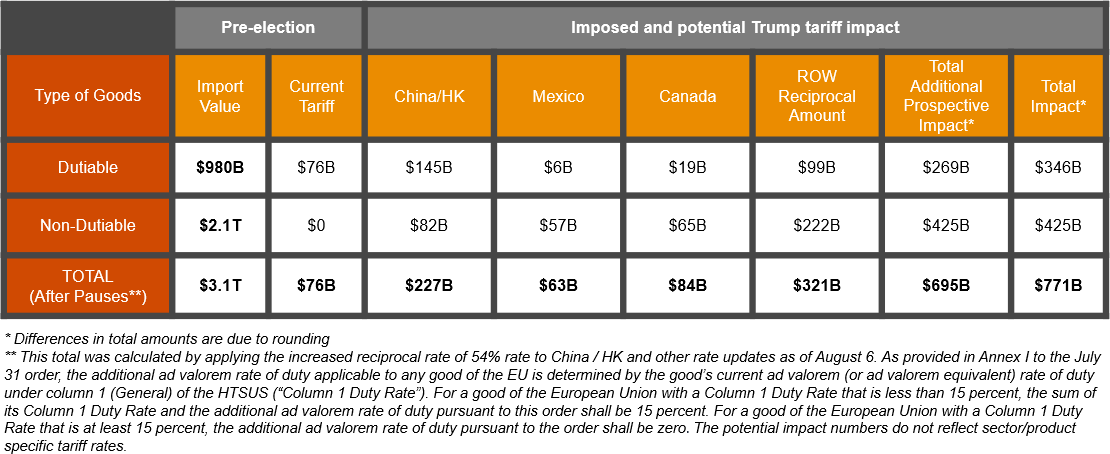

Based on PwC’s US Tariff Industry Analysis, Figure 1 below reflects revised projections of annual tariff impact based on the latest developments. See PwC’s prior Tax Insights dated June 11, July 11, July 18, and July 30 for more details regarding the assumptions and factors that are used in computing PwC’s Industry Analysis. PwC’s US Tariff Industry Analysis includes the following updates:

• Brazil – 50% (base of 10% plus an additional ad valorem duty rate of 40% on certain products)

• Updated tariff rates as outlined in Annex I of the July 31 executive order

• Canada – 35%

• Mexico – 25%

• India – 50% (25% plus an additional ad valorem rate of duty of 25%)

The figure does not include sector-specific tariffs, such as tariffs on copper of 50% and potential tariffs on pharmaceuticals and semiconductors.

Figure 1: Potential impact of Trump’s tariffs on US annual dutiable/non-dutiable imports based on calendar year 2024 data (updated August 6, 2025)

Compliments of PricewaterhouseCoopers – a Premium Member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)