An unpredictable and rapidly unfolding event has disrupted the global financial markets, coinciding with the end of the first quarter valuation processes for private debt funds. Private credit market valuation professionals are grappling with the fallout from the ongoing trade war may feel a sense of déjà vu, as they’ve navigated similar challenges in the very recent past.

The playbook for assessing fair value for private securities, developed during the onset of the COVID pandemic in March and April 2020, can serve as a useful framework for handling the immediate impact of tariffs—and tariff-related drawdowns in the public markets—on fair values and incorporating additional inputs as they become available.

Calm before the storm: Markets immediately after tariff announcement

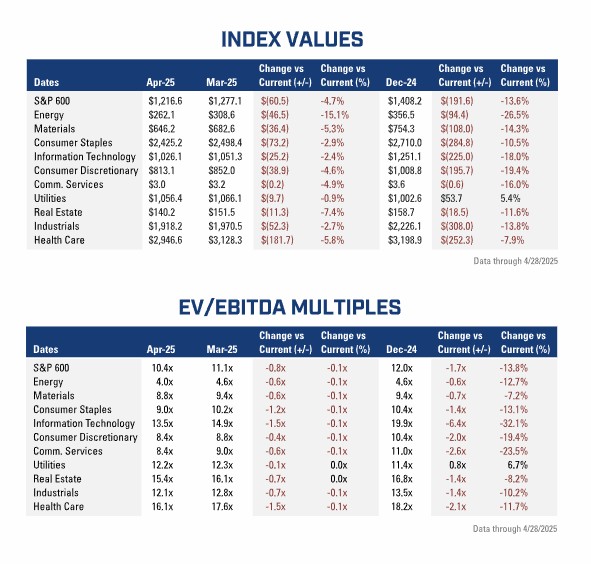

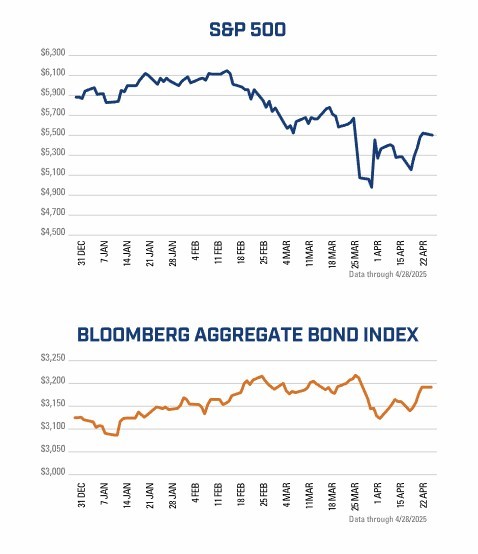

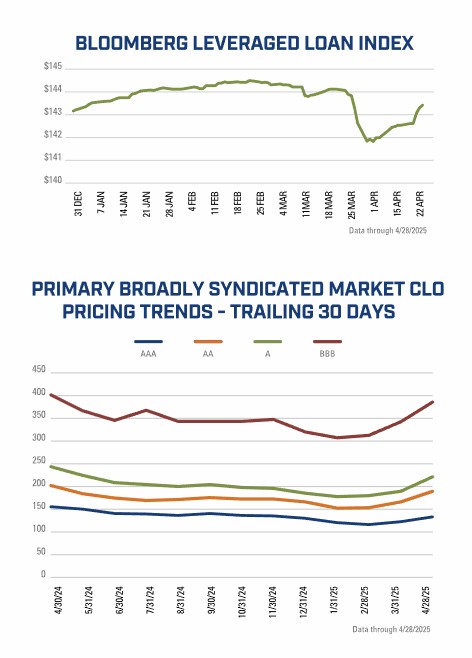

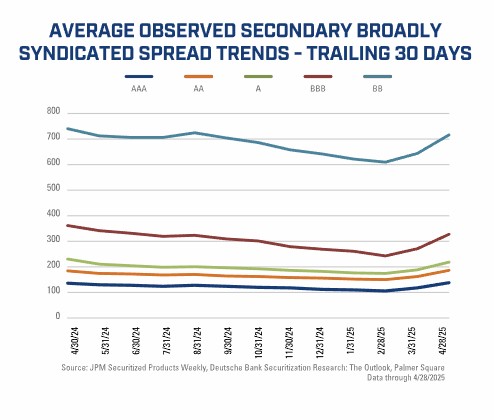

From these charts, it is clear that risk assets—including public stocks, bonds and broadly syndicated loans—were enjoying a remarkable period of low volatility and value appreciation in the months ahead of President Trump’s April 2 announcement of a 10% baseline tariff on imports from nearly all countries and larger “reciprocal” tariffs on an additional 90 or so nations. This period of calm was short-lived, as all three publicly traded risk asset markets gapped lower on the announcement.

The markets have yet to fully recover from the initial losses, despite some retracement of the losses in the broad markets (and the LL100 and B-rated Loan Indexes have remained at or near the lows). The White House’s 90-day reprieve on many of the policies announced on April 9 has not alleviated the uncertainty, with subsequent statements from the Administration adding to the uncertainty by including significant tariffs on China, prompting immediate retaliatory measures by Beijing, and carving out exemptions for certain product categories.

As for interest rates, the short end of the yield curve rallied in response to the initial announcement, with expectations of Fed easing in response to the anticipated negative impact of tariffs on U.S. economic growth. Overnight funding rates, such as SOFR, generally tracked short-term Treasury rates down.

However, the long end of the yield curve has backed up, which market observers attribute to forced selling by speculators unwinding the so-called basis trade and possibly a reassessment of U.S. dollar-denominated assets by longer-term foreign investors.

Meanwhile, a significant shift is underway in the collateralized loan markets (CLOs). As prime buyers of individual new issuance and secondary loans, market participants have observed a notable increase in secondary liability spreads – the paper used to finance CLO vehicles – in April. This, in turn, has led to a rise in new issuance CLO liability spreads across the ratings spectrum, albeit on relatively low volumes. Broadly Syndicated Loan (BSL) AAA tranche paper accounts for approximately 60% to 65% of CLO liability structures and has seen a significant price adjustment. Before the April tariff announcements, in late March, this paper was pricing in the 120bps to 130bps range; however, it is now pricing in the 150bps to 160bps range. Our analysis suggests that the Middle Market (MM) CLO markets are experiencing similar pricing trends. To achieve the required double-digit equity returns for new CLO issuance, managers will need to either secure higher new issuance loan spreads to offset the increased liability costs or supplement their portfolios with secondary loan purchases at below par prices, assuming these loans will eventually return to par. It is worth noting that these CLO pricing declines, although significant, are relatively modest compared to past market shocks, such as the Ukrainian/Russian War, COVID, and the Great Recession.

‘Pencils down’: The impact of the announcement on Q1 NAV strikes

The tariff announcement, which occurred immediately after the first quarter closed, created a dilemma for private credit valuation teams working on quarterly NAV. Many practitioners are likely revisiting their accounting textbooks or internal valuation policies to determine whether the sharp drawdown in publicly traded equities and credit instruments necessitates a reassessment of fair values.

The official guidance is clear: Under GAAP standards, practitioners are directed to consider only “known or knowable” information at the end of the quarter and then put their pencils down. While tariffs were a topic of discussion in financial markets ahead of the April 2 announcement, and spreads on speculative-grade secondary loans had widened modestly—approximately 20 basis points on single B-rated loans—toward the end of the quarter, the scope and impact of the tariffs were not yet fully understood.

But one need look no further than the public financial market’s convulsions in the days immediately following the announcement to conclude that the size and scope of the tariffs were unknown or unknowable on March 31.

For private securities going forward, private lenders are better suited to manage April and beyond valuations, even though tariff and geopolitical uncertainties remain, and there is an inability to assess the impact of the changing tariff regime on portfolio company fundamentals and the changes in public and private security underwriting standards.

The fair value implications of tariffs going forward

The announced tariffs are significantly impacting capital markets during the month of April, with low new deal volumes until market participants can ascertain the impact on specific market segments, high secondary market volatility as market participants speculate on pricing and engage in price discovery, and broad price erosion across capital markets as investors reprice risk upwards. Industries most impacted by tariffs are experiencing the most significant effects.

The announced tariffs are significantly impacting capital markets during the month of April, with low new deal volumes until market participants can ascertain the impact on specific market segments, high secondary market volatility as market participants speculate on pricing and engage in price discovery, and broad price erosion across capital markets as investors reprice risk upwards. Industries most impacted by tariffs are experiencing the most significant effects.

Direct private market transactions are typically given material consideration in private market valuations. However, when private M&A and LBO volumes and related financing are at very low volumes, determining market-clearing pricing during a market shift can be challenging. Under the SFAS 820 and IFRS 13 fair value standards, low market volumes, market dislocations, or heightened market volatility do not exempt market participants from determining the fair value of financial instruments. Generally, increased consideration needs to be given to comparable public market value indications to ascertain general and directional valuation indications of private market assets.

Evaluating volatile public market data as a proxy for private markets requires careful consideration and judgment, but ignoring the data entirely is not an option. Responsible practitioners may need to go the extra mile in collecting additional private market data, such as through interviews and surveys of market participants on their thoughts about shifts in new deal pipelines, including changes in pricing, leverage limits, and underwriting standards to better inform valuation decisions.

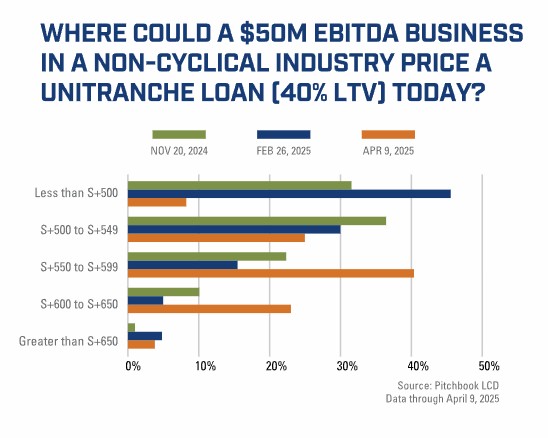

For now, new deal activity is di minimis. Pitchbook/LCD asked market participants where they would price new unitranche loan deals as of April 9, with half of the respondents estimating that pricing would fall within SOFR + 500-600 basis points, while 20% said it would be even higher. That compares to a strong consensus, ~80%, around 450-550 basis points as of mid-February.

A more nuanced, exposure-based approach to tariff impacts on fair value

Not every industry or borrower will be similarly impacted by a protracted trade fight. A detailed analysis of industry and company-specific factors is necessary to understand the potential effects of tariffs. With tariffs coming and many forecasters predicting a resultant slowdown or recession, borrower-level budgets and financial projections from the first quarter are no longer reliable and will need to be reassessed. However, revised adjusted financials or forecasts for tariff impacts may not be available for required April valuations, and likely not for second-quarter valuations.

To estimate the market impact on valuations of specific industries due to tariffs, public equity and credit markets can serve as proxies for the impact. The playbook developed during the pandemic, which involves identifying high-impacted, modestly impacted, and no- or low-impacted industries through qualitative knowledge and considering the secondary market loan, bond, and equity indices by industry, can prove useful in navigating the current tariff situation.

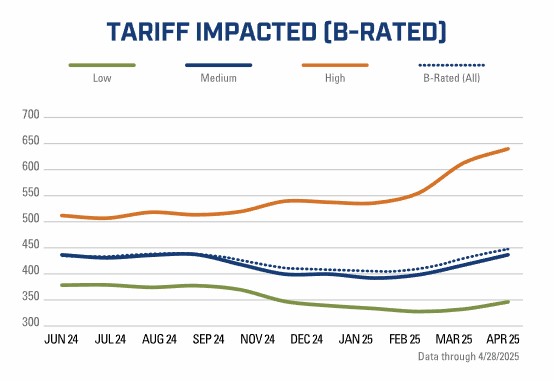

We examined discounted spread levels and trends since March 31 for B-rated secondary market credits in various industries for April private credit valuations. Even no- or low-impact industries (4 or 5) experienced a modest widening of credit spreads, generally in the 10bps to 40bps range, with a median of approximately 25bps.

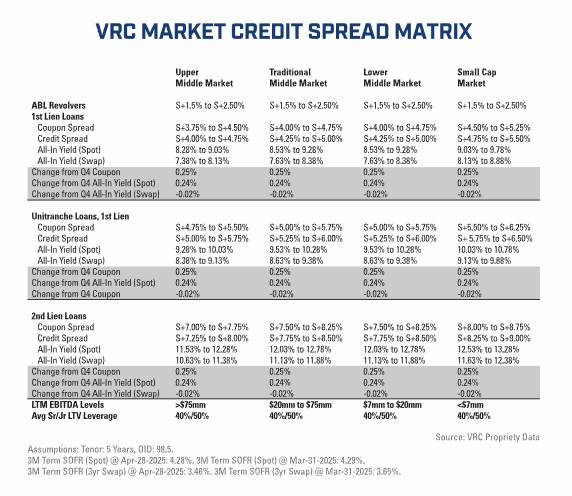

VRC’s private credit pricing matrix was adjusted to reflect this shift; all ranges moved 25 basis points wider than where they stood in March. This adjustment reflects the modest widening or repricing of base credit risk across the board.

Beyond that, we consider comparable enterprise value and credit spread movements to assess whether an additional risk adjustment is needed beyond the +25 basis point increase. This will include significant credit spread increases per industry, individual loan comparables, or materially lower enterprise values.

As our Tariff-Impacted chart data shows above, several industries are barely affected and show the 25 basis-point across-the-board increase we applied to account for the increased price of risk. While others are more significantly impacted, with some experiencing spreads more than 100 basis points wider since March and up to 200 basis points wider since year-end 2024. These findings highlight the varied impact of tariffs across industries.

As our Tariff-Impacted chart data shows above, several industries are barely affected and show the 25 basis-point across-the-board increase we applied to account for the increased price of risk. While others are more significantly impacted, with some experiencing spreads more than 100 basis points wider since March and up to 200 basis points wider since year-end 2024. These findings highlight the varied impact of tariffs across industries.

Overall, it is essential to note that VRC’s valuation analyses are performed on a bottom-up basis, reflecting company and market-specific factors. Our analyses consider case-by-case situations, focusing on fundamental performance, outlook, credit profile, and market technical. Therefore, some credits will continue to fare better than others, and a nuanced understanding of these factors is crucial in navigating the complexities of the current market environment.

Speaking with our private equity and credit clients, we found that most portfolio companies are in domestic business and software services, which will see little direct financial impact from tariffs. However, secondary and tertiary labor and end market impacts will need to be carefully examined. Hence, we would not expect a material downward valuation impact. For portfolio companies that may have a material negative financial impact from tariffs, we will need to rely on comparable companies’ public market valuation levels and trends until we can more directly model the impacts when revised pro forma financials and budgets considering tariff impacts are available.

Haves & have-nots: Second-order effects on the deal pipeline

While the primary market has been relatively quiet, there is too much dry powder on the sidelines to expect it to remain that way for long. The changed regime will likely impact the nature of deals going forward.

On one hand, with lenders and private equity investors nervous about tariffs and the economic prospects, pricing power may shift in favor of private capital players, resulting in lower private equity multiples and higher private credit spreads for those deals that may be going through, regardless of tariff impact. Borrowers with high exposure to tariff disruptions will likely see higher credit spreads and more conservative structures, if they can access the primary markets at all.

However, new deal supply will be very low, with M&A and LBO volumes coming to a trickle. Coupled with the material excess liquidity (dry powder) in the private equity and credit markets, this may create immense competition for the best deals, potentially leading to higher multiples and tighter private spreads. Also, direct lenders may hold credit spreads steady with pre-tariff levels and instead underwrite more conservatively (lower leverage levels, higher coverage ratios, tighter documents, and/or more covenants). This would result in additional return per unit of risk and effectively higher risk-adjusted returns.

Our conversations with our clients confirm that M&A deals for non-tariff-impacted, non-cyclical companies will likely be the first to clear markets. These companies will likely trade at similar pre-tariff impact multiples and have modestly higher financing costs (higher spreads and maybe lower leverage offered). VRC increased its credit spread and yield matrix by 25 bps, which is the low end of the estimated range, given the material volatility in the public markets and the upward rebound in public capital market credit spreads and enterprise values, when writing this update. Most plan to avoid high-impact industries, and those with some impact will likely trade at lower multiples and pay credit spread premiums to standard rates.

Conclusion

Private market valuation professionals have navigated similar challenges before, including the pandemic. By recognizing what they can and can’t know about the future impact of tariffs, applying techniques developed during COVID, following their valuation policies and procedures closely, and carefully documenting the basis for every decision and judgment call, they can weather the tariff turmoil in good shape. A proactive and informed approach will be essential in navigating the challenges of tariffs and maintaining a robust valuation process.

Compliments of Valuation Research Corporation – a member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)