July 30, 2025

What happened?

On July 27, the United States and the European Union (EU) announced a framework trade agreement and released a Fact Sheet on July 28 that calls for the reduction of proposed tariff levels and includes new bilateral investment and procurement commitments. The White House on July 22 released a Fact Sheet outlining the terms of the US–Indonesia reciprocal trade agreement, previously addressed in PwC’s July 18 Tax Insight. The fact sheet highlights key tariff, regulatory, and market access provisions across manufacturing, agriculture, digital trade, and labor.

Note: As of the date of this Tax Insight, Indonesia has not released a fact sheet or other details concerning this trade agreement.

On the same day, the Trump administration announced a trade and investment agreement with Japan and released a Fact Sheet on July 23. The United States and the Philippines also reached a preliminary trade agreement on July 22. As of the date of this Tax Insight, a White House Fact Sheet has not been released.

Why is it relevant?

The framework trade agreements between the United States and the EU, Indonesia, Japan, and the Philippines, provide greater clarity for businesses operating in these countries, while signaling broader trade policy shifts that are likely to affect operational supply chains and sourcing decisions in many industries. The administration is not solely focused on tariff rate changes to level the playing field, but also the elimination of non-tariff barriers to open commercially meaningful market access for US companies, as well as securing certain commitments for foreign direct investment. These agreements are changing a broad breadth of trade-related issues across industries.

Actions to consider

Impacted companies should assess how revised tariff rates, expanded market access, and regulatory changes may impact supply chains and cross-border pricing, and any compliance obligations. The wide nature of changes in these agreements is likely to prompt the need for more in-depth analysis and modeling to fully inform C-suite decision-making. Companies may begin to evaluate trends with respect to tariff rates and market access concessions for specific industries that could be repeated in future US trade deals.

In detail

This Tax Insight provides a high-level overview of initial trade agreements between the United States and the EU, Japan, Indonesia, and the Philippines as well as the potential dollar impact they will have related to tariff amounts in the United States. As of the date of this Tax Insight, the recent agreements have not been formalized by law or an executive order. While some fact sheets have been released by the White House, detailed implementing instructions have not yet been issued to provide much needed clarity on sector specific details in relation to ongoing Section 232 investigations by the Department of Commerce.

US-EU trade agreement

On July 27, less than a week before reciprocal tariffs are set to take effect, the United States and the EU reached a framework trade agreement. The agreement imposes a 15% reciprocal tariff on most EU goods entering the United States, including autos, auto parts, pharmaceuticals, and semiconductors. In addition, according to the EU’s Fact Sheet released July 28, tariffs on certain EU strategic products will have special treatment, including aircraft and component parts, certain generic drugs and chemicals, and some natural resources, which will return to pre-January 1 levels as of August 1. Tariffs on EU-origin steel, aluminum, and copper will remain at 50%, and both parties have agreed to hold discussions on supply chain security for these materials. In return, the EU agreed to purchase $750 billion in US energy exports through 2028 in addition to investing $600 billion in the US economy under the Trump administration, which is in addition to the $100 billion currently invested in the United States by EU companies. The EU also agreed to make significant purchases of US military equipment. The Fact Sheet addresses the EU’s commitment to eliminating tariffs on select goods, including the removal of all tariffs on US industrial goods shipped to the EU. In addition, tariffs on various sectors will be eliminated by the EU, and quotas will be established for other US products shipped to the EU. The Fact Sheet highlights a commitment by the EU to address non-tariff barriers affecting US industrial and agricultural exports. For industrial goods, to eliminate red tape, the EU will work to reduce regulatory requirements and procedural burdens, particularly those impacting small and medium-sized US exporters. In the agricultural sector, both parties intend to streamline import processes, including simplification of sanitary certificate requirements for products such as US pork and dairy. The agreement includes strong rules of origin so that the benefits of the deal accrue solely to the United States and the EU, and not to third countries. In the area of digital trade, the White House Fact Sheet indicates that the EU has committed not to impose network usage fees, and both parties will continue to

“maintain zero customs duties on electronic transmissions.” The agreement also emphasizes economic security, with the United States and EU pledging to coordinate on export controls, investment reviews, duty evasion enforcement, and addressing policies of non-market third parties. Finally, the two sides have agreed to acknowledge a set of major commercial agreements in sectors such as energy and semiconductors.

Observation: The US–EU trade agreement represents a significant step toward strengthening this important bilateral economic relationship. It also appears to prevent significantly higher tariffs ranging from 30% to 50% that had been proposed on imports into the United States from the EU. With commitments spanning tariffs, investment, digital trade, and regulatory cooperation, the agreement provides additional clarity for businesses operating across a wide range of sectors, although more details are needed especially with respect to products that qualify for zero-for-zero tariffs. PwC’s updated Industry Analysis reflects that the total tariff impact for EU imports into the United States could be over

$90 billion annually.

US–Japan trade agreement

On July 22, the United States and Japan announced a framework trade agreement under which Japanese imports will be subject to a 15% reciprocal tariff, reduced from the previously proposed 25%. According to the Fact Sheet, Japan pledged to invest $550 billion directed by the United States to rebuild and expand core American industries. The Japanese government has noted that this will support Japanese investments into the United States in areas such as energy, semiconductors, critical minerals, pharmaceuticals, and shipbuilding. No detail was provided on how the funds will be provided and who the recipients will be. The agreement enables market access for American producers into Japan, including the removal of longstanding restrictions to US cars and trucks and recognition of US vehicle standards, as well as broader openings for a range of industrial and consumer goods. The deal also includes an agreement for specific direct purchases from the United States, including the purchase of 100 aircraft, billions of dollars annually of defense equipment, and $8 billion in agricultural and other products (such as a 75% increase in rice purchases; bioethanol and aviation fuel). As part of the agreement, Japan is exploring a new offtake agreement with respect to a liquefied natural gas (LNG) pipeline project in Alaska.

Observation: With a baseline 15% reciprocal tariff on Japanese imports and the significant investments by Japan directed toward US strategic industries, the US-Japan trade deal signals a substantial rebalancing of trade relations and a long-term investment in American industrial capacity.

Breakthroughs in market access are expected to deliver significant benefits to US exporters, although the impact likely will depend on the company’s operational footprint and product, such as in the auto sector. PwC’s updated Industry Analysis reflects that the total tariff impact for Japan imports into the United States could be almost $24 billion annually.

US–Indonesia trade agreement

The White House’s July 22 Fact Sheet provides an outline of the reciprocal trade agreement with Indonesia, previously announced on July 15. Under the deal, Indonesia will face a 19% reciprocal tariff rate on its exports to the United States. In return, Indonesia will eliminate tariff barriers on over 99% of US exports, including agriculture, healthcare, seafood, information and communications technology, automotive products, and chemicals. The Fact Sheet also details many significant non-tariff reforms, including removing barriers for US industrial and agricultural exports, strengthening rules of origin, exempting local content requirements and certain certification requirements, aligning on economic security, and improving labor standards. Restrictions are removed on certain exports to the United States, including critical minerals. In addition, the deal removes certain barriers for digital trade, such as eliminating Harmonized Tariff Schedule (HTS) tariff lines on “intangible products” and supporting a permanent moratorium on customs duties on electronic transmissions by the World Trade Organization (Indonesia has historically opposed this effort). In addition, the deal includes specific direct investment by Indonesia of products such as aircraft currently valued at $3.2 billion, agriculture products, including soybeans, soybeans meal, wheat, and cotton with an estimated total value of $4.5 billion, and energy products, including liquefied petroleum gas, crude oil, and gasoline, with an estimated value of $15 billion.

Observation: For the United States, the deal is expected to unlock significant market access for American farmers, manufacturers, innovators, and producers into a market with incredible potential due to its expanding consumer base. As compared to prior deals in Asia-Pac, Indonesia was not able to achieve greater tariff reductions than for example, Vietnam. PwC’s updated Industry Analysis reflects that the total tariff impact for Indonesia imports into the United States could be $6.7 billion annually.

US–Philippines trade agreement

The United States and the Philippines also reached a preliminary trade agreement on July 22. Under the agreement, the United States will impose a 19% tariff on Philippine exports, while the Philippines agreed to eliminate tariffs on all US exports.

Observation: The reduction to 19% is relatively small, down from generally 20%. Although a Fact Sheet has not been released by the White House at the time of this publication, it appears that the administration is focused on reducing barriers to foreign market access, like other agreements. PwC’s updated Industry Analysis reflects that the total tariff impact for the Philippines imports into the United States could be $2.7 billion annually.

General sector observations

Recent trade deals are expected to provide significant economic benefits to certain companies and industries. However, uncertainty is still looming with respect to countries still negotiating with the administration. In addition, the agreements announced so far are in principle only until a formal agreement is formulated with more details. The following are some broad observations based on the respective trade frameworks:

Consumer products

For the consumer products industry, the lowering of non-tariff barriers with respect to agriculture and other consumer product exports to the EU is a welcome development to open EU market access. Companies with initially the most to gain under the US-Japan trade deal are food and beverage, personal care, and household goods, where non-tariff barriers to entry into the lucrative Japanese market have long precluded US companies from competing effectively. Additionally, the pledged investments may add a secondary boost to this sector. With respect to the US-Indonesia trade agreement, the administration is aiming to create significant benefits to US farmers and ranchers. The Indonesia deal also helps to alleviate other regulatory burdens for specific items exported from the United States such as cosmetics.

Industrial Products and Manufacturing

The US-EU deal promises to level the playing field such that US exporters can more freely access EU markets. The potential allowance of zero-for-zero tariffs for aircraft, semiconductor equipment, certain raw materials and chemicals is likely to help producers within both the United States and the EU. However, steel and aluminum tariffs remain at 50%. For the US-Japan trade deal, the industrial products and manufacturing sector appears to be treated the same as other goods under the current 15% tariff framework. In general, the potential for future Section 232 actions — particularly in areas such as semiconductors — could alter the tariff landscape for select categories within this sector. Regarding Indonesia, the administration is aiming for this trade deal to create significant benefits for manufacturers given the commitment by Indonesia to buy certain products.

Pharmaceutical and Medical Device

With respect to the US-EU deal, it appears that certain generic drugs may benefit from zero-for-zero tariffs; however, other pharmaceuticals may be subject to the 15% rate under this deal. It is still unclear how the 15% rate set forth in the US-EU deal will be impacted by potential Section 232 pharmaceutical tariffs for which an investigation is still underway by the Department of Commerce. The effect of the $550 billion by Japan for investment in the pharmaceutical sector is unclear at this time as companies will need to closely follow the release of more details.

Energy Utilities & Resources

The EU’s agreement to purchase $750 billion of US energy exports through 2028 is expected to give an important boost for many energy providers. The improved access to European markets is expected to streamline transatlantic trade and advance supply chain resilience. The US–Japan tariff agreement brings greater clarity and predictability to energy-related trade, particularly benefiting fossil fuel initiatives and easing cost pressures on equipment used in the renewable energy sector. In addition, the agreement opens up expanded opportunities for US energy producers to access and compete in the Japanese market. For Indonesia, the administration is aiming for this trade deal to create significant benefits to US energy providers given the Indonesian commitment to buy certain products.

Automotive

The tariff rate on automobiles from Japan is anticipated to be 15%. The agreement allows for a reduced tariff on automotive imports from Japan, down from the 27.5% proposed by the administration. In contrast, vehicles manufactured in other North American jurisdictions, which could include a higher proportion of US content, may currently be subject to higher tariffs. The US-Japan and US-EU trade deals might pave the way for similar tariff reductions with other trade partners (i.e., Canada, Mexico, South Korea), which are currently pressing the automotive sector. Regarding the US-Indonesia trade agreement, the administration is aiming for this deal to create significant benefits to automakers given the lowering of trade barriers. Based on oral comments, the Philippines appears willing to reduce tariffs and open its market for automobile imports, which could be favorable for US automakers.

Technology

The US-EU trade deal is likely to have mixed impact, with details unknown at the present time given that some products may or may not be subject to the 15% tariff rate. EU tech exports like chips and aerospace parts may fare better, while autos and pharmaceuticals may face greater cost pressure in the United States. US-based tech infrastructure, AI investment, and energy-related tech sectors should benefit from increased EU capital flows. With respect to the US-Indonesia deal, tech companies stand to benefit given the digital trade reforms sought for many years. Although US tech firms could gain dramatically from tariff-free access into Indonesia, tech exporters from Indonesia will face elevated cost barriers to US markets. With respect to the US-Japan deal, US technology infrastructure — especially chip fabrication and data centers — stands to benefit heavily.

Mergers and acquisitions

The acceptance of recent trade deals, combined with enactment of the One Big Beautiful Bill Act, may spur increased mergers and acquisitions activity as companies look to capitalize on expanded market access, streamlined regulations, and clearer tax frameworks. These developments may reduce cross- border friction and provide greater certainty, encouraging strategic acquisitions to accelerate growth, improve supply chains, and realign global operations in response to shifting tax incentives and compliance requirements.

Tariff impact

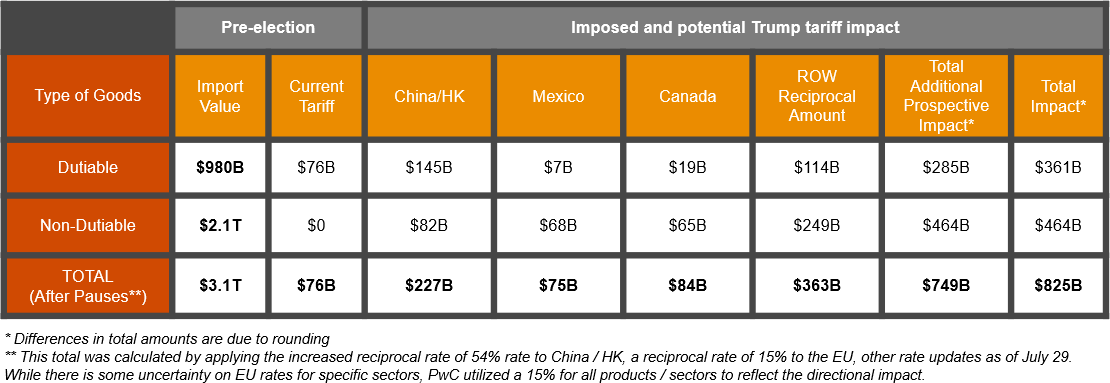

Based on PwC’s US Tariff Industry Analysis, Figure 1 below reflects revised projections of annual tariff impact based on the latest developments. PwC’s US Tariff Industry Analysis includes the following rates:

• Indonesia – 19%

• Japan – 15%

• Philippines – 19%

• European Union – 15%

The figure does not include sector-specific tariffs, such as tariffs on copper of 50% and potential tariffs on pharmaceuticals and semiconductors. See PwC’s prior Tax Insights dated June 11, July 11, and July 18 for more details regarding the assumptions and factors that are used in computing PwC’s Industry Analysis.

Figure 1: Potential impact of Trump’s tariffs on US annual dutiable/non-dutiable imports based on calendar year 2024 data (updated July 29, 2025)

Compliments of PricewaterhouseCoopers – a Premium member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)