The big news in the mergers and acquisitions world late last week was Netflix Inc.’s agreement to buy Warner Bros. Discovery Inc. in a deal valued at $82.7 billion.

The acquisition would create an entertainment behemoth, if it passes regulatory muster. Netflix would come to own the Sopranos, Big Bang Theory, and Game of Thrones franchises. More importantly to those in the commercial real estate world, it would assume Warner’s studio movie-making chops. And that’s where the potential headaches come up.

Warner has been among the top-grossing movie distributors over the past 30 years, second only to the Walt Disney Co. It typically produces movies and generates revenue by distributing them through movie theaters. That business model could be up-ended.

Netflix executives noted they didn’t oppose theatrical releases, but said the company’s acquisition of Warner would provide greater options for viewers. That could mean that the length of time movies are shown exclusively in theaters gets shortened. So, who needs theaters?

Cinema United, the former National Association of Theatre Owners, which represents 31,000 movie screens nationwide, said it was opposed to the proposed deal, arguing that it presents “an unprecedented threat to the global exhibition business.” The deal would “impact theaters, from the biggest circuits to one-screen independents in small towns in the U.S. and around the world.”

Below, in the Data Point of the Day, we detail the potential impact on the CMBS sector.

The reality is that the movie theater business isn’t what it used to be. Going to the local theater to catch a flick once was a monthly, if not weekly, ritual for many. It’s now almost a rarity.

A possible reason: movies just aren’t what they used to be. You won’t find a Gone With the Wind—which some argue is the all-time box-office sales leader—among any production company’s titles. The last movie to gross more than $2 billion was Avatar: The Way of Water, and that was in 2022. The top grossing movie so far this year: A Minecraft Movie, which so far has grossed $423.95 million. Inside Out 2, the top movie last year, generated $652.98 million in ticket sales, according to The Numbers, a data and research service that closely tracks the movie business.

This year, 762.23 million movie tickets are expected to be sold. That compares with the 1.23 billion tickets that were sold in 2019 and 1.4 billion in 2000, according to The Numbers. Of course, ticket prices have increased, to an average of $11.31 this year from $9.16 in 2019 and $5.39 in 2000.

The total box office take this year is slated to be $8.62 billion. That compares with $11.26 billion in 2019 and $7.56 billion in 2000. But if you adjust those numbers for inflation, the delta becomes greater. The inflation-adjusted numbers for 2019 and 2000 were $13.91 billion and $15.85 billion, according to The Numbers.

Meanwhile, the number of movie theaters across the country has declined to 38,000, according to Cinema United. In 2019, the country had 41,000 theaters.

Data Point of the Day

Movie Theater Tenant Exposure

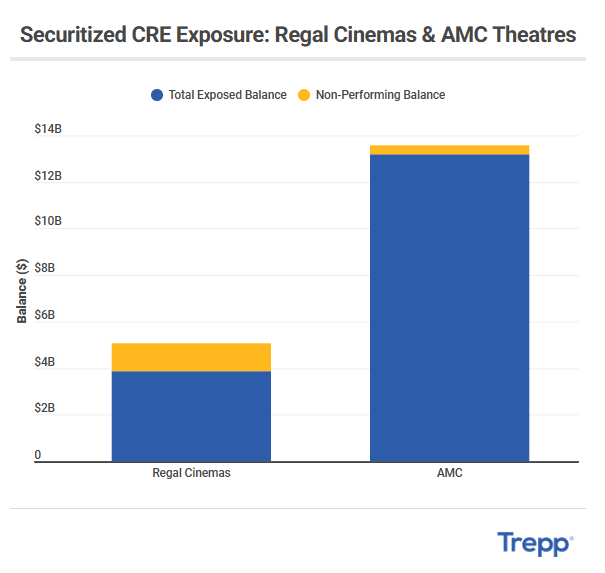

The proposed Netflix-Warner Bros. Discovery merger could reshape theatrical release strategies and ripple through retail co-tenancy, making tenant credit profiles critical for CMBS surveillance. Trepp data show stark contrasts between Regal Cinemas’ and AMC Theatres’ exposures: Regal’s $3.85 billion footprint carries a 33.6% nonperforming share, while AMC’s $13.2 billion portfolio reports only 2.8% nonperforming. Beyond headline figures, structural metrics reinforce the gap: Regal’s weighted average debt-service coverage ratio is 1.74x with a loan-to-value ratio of 57%, compared to AMC’s stronger 2.09x DSCR and 50% LTV, signaling greater refinance resilience for AMC-backed loans. Recent originations amplify the story: Regal appears in older superregional malls and single-tenant deals, including assets with DSCRs below 1.0x, while AMC features in high-profile, mixed-use and urban retail projects with DSCRs above 1.7x and tenant shares often under 30%, reducing single-tenant risk. Coupon trends matter, too: both chains face 2024-2025 loans priced in the 7%-8% range, but AMC’s stronger coverage cushions rate pressure, whereas Regal’s thinner margins heighten extension and modification risk.

For investors and lenders, this dispersion means co-tenancy and valuation stress will concentrate in Regal-heavy centers if content pacing slows or windows compress, while AMC’s diversified footprint offers relative stability. By pairing delinquency data with leverage and DSCR trends, this dataset frames where refinancing hurdles and potential tranche volatility are most likely as streaming consolidation reshapes theatrical economics.

Compliments of Trepp – a Premium member of the EACCNY

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)