Dow Lecture by Philip R. Lane, Member of the Executive Board of the ECB, at the National Institute of Economic and Social Research | London, 16 February 2023 |

Introduction

It is an honour to deliver this year’s Dow Lecture. Christopher Dow had a distinguished career as an applied macroeconomist, both in the United Kingdom (at the Bank of England, the Treasury and here at NIESR) and internationally (as OECD Chief Economist from 1963 to 1973).[1] Moreover, he extensively analysed my topic today – the impact of interest rate movements on the financial system, the economy and inflation – including in the context of the cost-push inflation pressures of the 1970s and 1980s.[2] While the current inflation environment is quite different in many respects – having been driven predominantly by extraordinary external factors such as the COVID-19 pandemic, supply bottlenecks and energy shocks – much can still be learned by re-visiting the analysis by Christopher Dow of the macro-financial dynamics and policy challenges associated with cost-push inflation.

My aim today is to provide an interim analysis of the ECB’s current policy rate tightening cycle.[3] I will first describe the projected impact of monetary policy in the range of macroeconomic models maintained by the ECB. Next, I will report on the accumulating evidence about the impact of the policy tightening cycle on the financial system, the economy and inflation. In view of the long and differential lags in the transmission of monetary policy, this evidence is necessarily partial and of an interim nature. Still, it is essential to monitor closely the incoming evidence, since the efficient calibration of monetary policy must take into account the feedback loops between monetary policy, the financial system, the economy and inflation.

Beginning in December 2021, the ECB unwound its highly accommodative monetary policy stance in several phases. First, the pace of net asset purchases was reduced, including through the ending of net purchases under the pandemic emergency purchase programme in March 2022. Net asset purchases under the asset purchase programme further shifted down from April 2022 and concluded in June 2022. In July 2022, we began raising the ECB key interest rates. The €STR forward curve – the benchmark for key overnight lending in the euro area – began shifting up in December 2021, as markets began pricing in the start of ECB policy normalisation. This induced a tightening impulse even before we began raising actual policy rates.

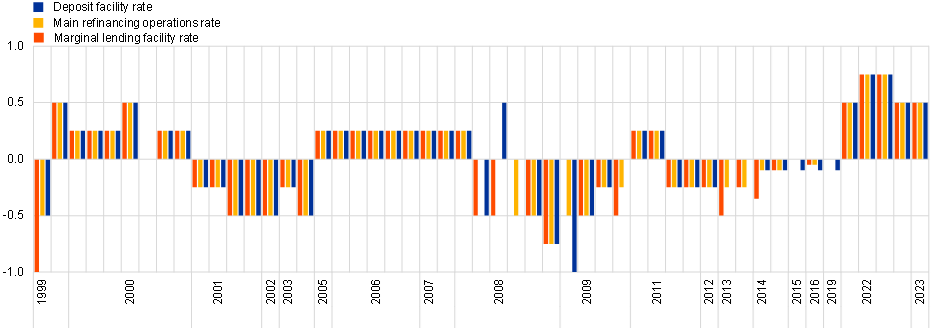

The speed and the scale of the back-to-back rate adjustments since July stand out in the history of the monetary union (Chart 1). By now, we have raised rates by a cumulative 300 basis points, bringing the deposit facility rate – which, in the current conditions of ample excess liquidity, constitutes the main instrument for steering the monetary policy stance – to 2.5 per cent. Furthermore, we have also signalled that we intend to raise the deposit facility rate by another 50 basis points at our March meeting and we will then evaluate the subsequent path of our monetary policy. This evaluation will necessarily turn on two basic considerations: first, an updated assessment of the medium-term inflation outlook (both the modal path and the risks to this outlook) second, an updated assessment of the appropriate monetary policy stance to make sure that inflation returns to our two per cent target in a timely manner. In turn, both parts of this assessment involve judgements on the impact of the monetary policy adjustments that have already occurred since December 2021.

Chart 1

Changes in the key ECB policy rates

(percentage point changes)

Source: ECB.

Note: The latest observation is for 8 February 2023.

Calibrating changes in the policy stance and monitoring the transmission to the financial system, the economy and inflation presents policymakers with three challenges. The first is to produce a reasonable (counterfactual) forecast of where inflation would head without an adjustment in monetary policy. The second is to develop reasonable estimates of how an adjustment in monetary policy would alter that inflation trajectory. The third is to carefully monitor each step in this transmission from monetary policy to the economy and inflation, gathering evidence along the way on how this transmission conforms with past regularities or, if it does not, to better understand how and why the specific features of the current macro-financial environment might alter the strength and speed of monetary policy transmission. It is worth pointing out that, regardless of the origin of an inflation shock, the working assumption is that monetary policy operates on the demand side, with rate hikes reducing inflation through the dampening impact of tighter financing conditions on the level of aggregate demand. Nevertheless, watching for heterogeneities in the transmission across sectors and analysing the potentially considerable and state-dependent lags in the transmission is essential and I will return to this point throughout this lecture.

In this lecture, I will leave the question of forecasting aside and focus on the latter two points: how to form a view on the typical transmission regularities, and how to cross-check them against the incoming data along the way.

Let me first review the set of models that ECB staff use to inform policy decisions and present the macroeconomic effects these assign to monetary policy. As the bulk of these effects on the economy and inflation are expected to materialise only over the coming two to three years, I will then go through a set of more timely signals that may be gathered along the way and that can act as checkpoints on the path of transmission.

To date, these signals for the most part point to a strong and orderly transmission of the ECB’s policy tightening to the relevant financial and real variables. But, especially since this transmission process is still unfolding, I will conclude with a set of open questions on the impact of the ongoing policy tightening that can only be settled conclusively at a more mature stage of the process.

CONTINUE READING HERE

Compliments of the European Central Bank.

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)