Background:

The Global Minimum Tax (GMT) represents a major step forward in international cooperation on the taxation of multinational enterprises (MNEs). It will ensure that MNEs with revenues above EUR 750 million are subject to a 15% effective minimum tax rate wherever they operate. The GMT, introduced by the Global Anti-Base Erosion (GloBE) Rules, is a key part of Pillar Two of the two-pillar solution. Agreed by over 135 member jurisdictions of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (Inclusive Framework on BEPS) in October 2021, the two-pillar solution is a historical agreement that aims to address the tax challenges arising from the globalisation and digitalisation of the economy. Since then, the implementation of the GMT has progressed with around 55 jurisdictions already taking steps toward implementation and with the rules coming into effect in 2024.

Methodology:

New OECD analysis examines the impact of the GMT on the taxation of MNEs, using new data on MNE worldwide activity and updated and more granular estimates of global low-taxed profit worldwide. The analysis updates and extends previous OECD work in several ways:

• First, the analysis relies on data for the years 2017-2020 with improved coverage of the global distribution of profit and activities of large MNEs (i.e., those with revenues above EUR 750 million).

• Second, the analysis reflects the agreed final design of the GloBE Rules.

• Third, the analysis better approximates the calculation of GloBE Income and the effective tax rate calculated under the GloBE Rules (GloBE ETR). In particular, the methodology performs adjustments to account for certain temporary book and tax differences in a manner consistent with the GloBE Rules.

• Fourth, the analysis relies on a new methodology to build more comprehensive estimates of global low-taxed profit. The new methodology shows substantial low-taxed profit in high tax jurisdictions. This improvement is key to modelling top-up taxes arising from the GMT in all jurisdictions.

• Fifth, the analysis introduces updated assumptions regarding the implementation of the GMT. The new assumptions capture governments’ incentives to introduce Qualified Domestic Minimum Top-Up Taxes (QDMTTs) as well as various developments in the ongoing implementation of the GMT.

Results:

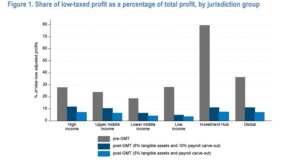

The GMT is estimated to reduce global low-taxed profit by about 80%; from 36% of all profit globally to about 7%. This reduction stems from both the reduction in profit shifting and the application of top-up taxes. The remaining low tax profit mainly reflects the impact of the substance-based income exclusion. This reduction is present in all income groups, but largely concentrated in investment hubs (Figure 1). Remaining low-taxed profit is largely due to the presence of the substance-based income exclusion (SBIE), where the GMT takes account of the real economic activities of MNEs.

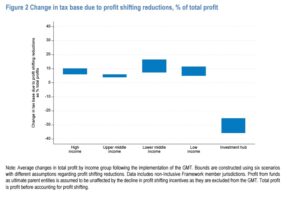

Under the GMT, shifted profit is estimated to fall by half due to strongly reduced profit shifting incentives, although these effects may take time to materialise. Reduced profit shifting means that more profit will be located where MNEs have significant economic activities, which may particularly benefit developing countries given that academic research has suggested they are more exposed to profit shifting. Investment hubs are estimated to lose approximately 30% of their tax base due to reduced profit-shifting, which translates into revenue gains for other jurisdictions (Figure 2).

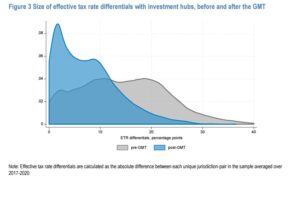

Differences in taxation between jurisdictions are estimated to fall, which will likely increase the importance of non-tax factors in influencing investment decisions and improving the allocation of capital globally. As a result of the increase in the taxation of low-taxed profit worldwide, the average tax rate differential across all jurisdictions falls by around 30%. The reduction in tax rate differentials between investment hubs and non-hub jurisdictions is even stronger. Figure 3 shows the distribution of tax rate differentials between investment hubs and non-hubs. While differentials are much higher before the GMT (in grey). Under the GMT (in blue) differentials shrink substantially, with a very high mass below 5%.

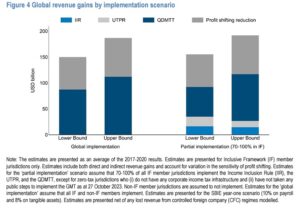

Global corporate income tax (CIT) revenues are estimated to increase as a result of the application of top-up taxes and reduced profit shifting. The GMT is estimated to raise additional CIT revenues of USD 155-192 billion globally each year or between 6.5% and 8.1% of global CIT revenues (Error! Not a valid bookmark self-reference.), with one third of these gains coming from reduced profit shifting. Estimated revenue gains are expected to accrue to all jurisdiction groups, with the distribution of revenue gains depending on the assumptions on governments’ implementation and MNEs’ behavioural reactions. The analysis highlights that the implementation of QDMTTs can be an important tool for jurisdictions to collect top-up taxes from low-taxed profit arising in their own jurisdiction.

For the full paper please visit the OECD website

Compliments of the OECD

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)