1 Introduction

The UK referendum on EU membership in 2016 has set the course for the most significant change to the relationship between the United Kingdom and its closest trading partners for decades. The primary interest from the ECB’s perspective is to understand the likely impact on trade of the departure of the United Kingdom from the European Union, as the United Kingdom has long been one of the euro area’s major export markets.

This article reviews the development of UK import demand and balance of payments since the referendum in order to assess the likely implications for euro area foreign demand.[2] It focuses on early insights into factors which have affected UK imports in the period between the referendum and the start of the coronavirus (COVID-19) pandemic. The departure of the United Kingdom from the EU could potentially result in some disruption to euro area export growth in the coming years if, for instance, UK import demand is reduced or diverted as a consequence of Brexit.

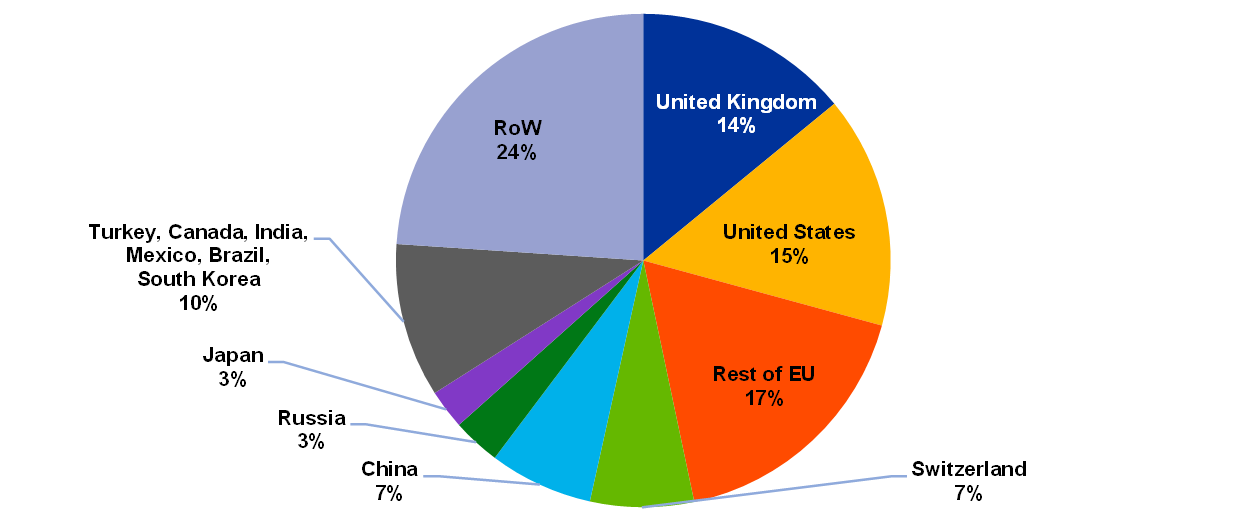

The United Kingdom has long been a major trading partner for the euro area, accounting for around 14% of euro area foreign demand over the period 2016-18 (Chart 1). Until the mid-2010s, when the 2015 general election paved the way for the referendum, the United Kingdom had been the euro area’s largest single trading partner – even ahead of the United States. Developments in foreign demand are a major determinant of euro area GDP growth as non-euro area imports and exports of goods and services amount to around half of euro area GDP.

Chart 1

Euro area export destinations

(share of exports of goods and services, 2016-18 average)

Note: RoW stands for the rest of the world.

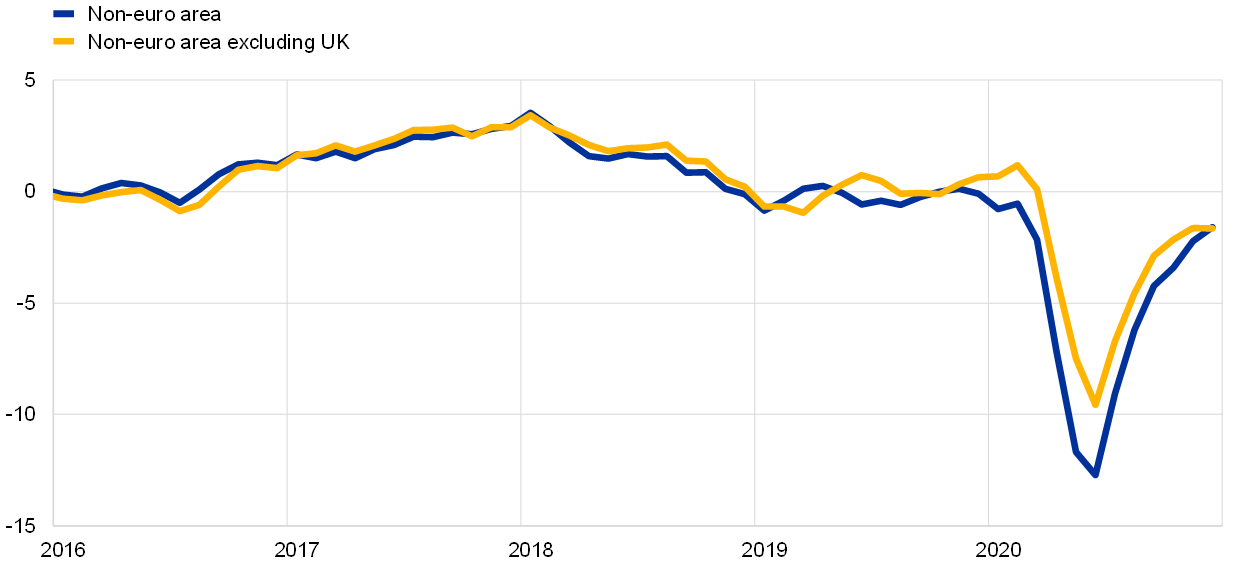

Since the 2016 referendum, the UK’s share of euro area foreign demand has fallen somewhat, largely reflecting a notable slowdown in the growth of UK imports from the EU and, correspondingly, a sizeable drag on euro area exports (Chart 2). A marked deceleration in the growth of UK import demand since the end of 2017 has exacerbated a broader slowdown in the growth of non-euro area foreign demand, which has weighed on euro area export growth. In addition, uncertainties surrounding the various Brexit deadlines throughout much of 2019 and 2020 resulted in considerable quarterly volatility in the UK component of euro area foreign demand.

Chart 2

Euro area exports to non-euro area countries

(annual percentage changes of three-month moving averages, monthly data)

Notes: Exports of goods and services. The latest observation is for December 2020.

CONTINUE READING HERE

Compliments of the European Central Bank.

![European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://eaccny.com/wp-content/uploads/2020/06/eaccny-logo.png)